(Solved): Becker CPA Review 3-6 Bill and Anne Chambers are married and file a joint return. They have no child ...

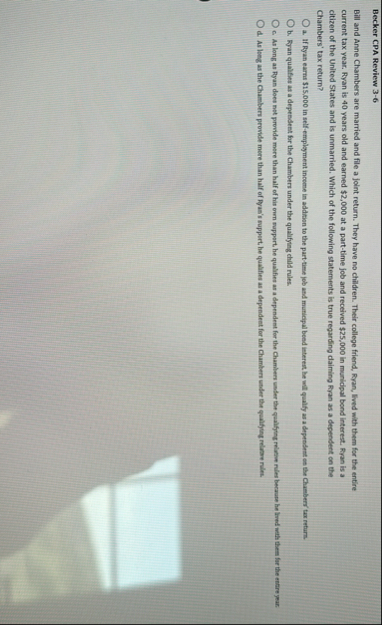

Becker CPA Review 3-6 Bill and Anne Chambers are married and file a joint return. They have no children. Their college friend, Ryan, lived with them for the entire current tax year. Ryan is 40 years old and earned

$2,000at a part-time job and received

$25,000in municipal bond interest. Rran is a citizen of the United States and is unmarried. Which of the following statements is true regarding daining Royn as a dependent on the Chambers' tax return? a. If Ryan earns

$15,000in self-emplayment income in addrion to the part time job and muticipal beed interest be will qualfy as a drpendent en sur Chambers tux return. b. Ryan qualifies as a dependent for the Chambers under the qualifying child rules. d. As long as the Chambers provide more than half of Bas's nuppert, he qualfies as a dependent for the Chambers under the qualfong relase niles.