Home /

Expert Answers /

Finance /

1-during-the-year-2012-yung-com-had-sales-of-1000-costs-of-goods-sold-of-400-pa869

(Solved): 1. During the year 2012 , Yung.com had sales of \( \$ 1000 \), costs of goods sold of \( \$ 400 \) ...

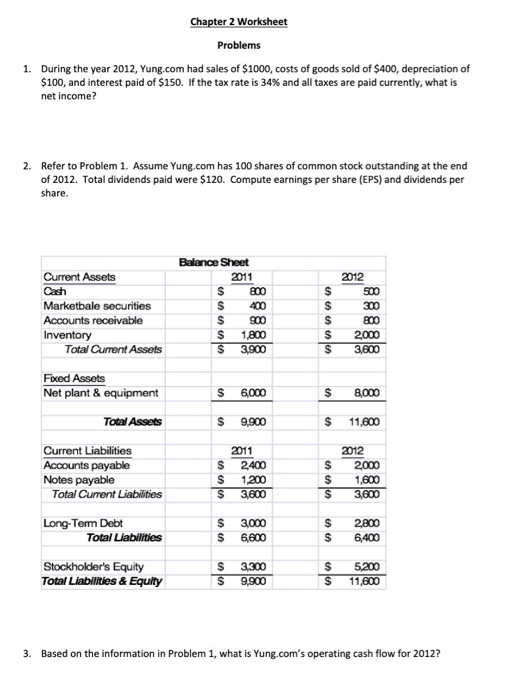

1. During the year 2012 , Yung.com had sales of \( \$ 1000 \), costs of goods sold of \( \$ 400 \), depreciation of \( \$ 100 \), and interest paid of \( \$ 150 \). If the tax rate is \( 34 \% \) and all taxes are paid currently, what is net income? 2. Refer to Problem 1. Assume Yung.com has 100 shares of common stock outstanding at the end of 2012. Total dividends paid were \( \$ 120 \). Compute earnings per share (EPS) and dividends per share. 3. Based on the information in Problem 1, what is Yung.com's operating cash flow for 2012?

4. Based on the balance sheets for Yung.com, what was net working capital for 2011? For 2012? What must changes in net working capital have been? 5. What was Yung.com's free cash flow to the firm in 2012? 6. What was Yung.com's total cash flow to long-term creditors in 2012? 7. What was Yung.com's cash flow to shareholders in 2012?

Expert Answer

The net income becomes the residual earnings a business derives after it meets all of its expenses. Compute the Profit before taxes as shown below: - Profit before taxes = Sales - COGS -Depreciation - interest Profit before taxes = $1,000 - $400 -$10