Home /

Expert Answers /

Economics /

1-using-the-formula-for-the-consumption-function-c-a-mpcx-income-and-the-formula-for-the-savi-pa805

(Solved): 1) Using the formula for the consumption function ( C=A+[mpcx income]) and the formula for the savi ...

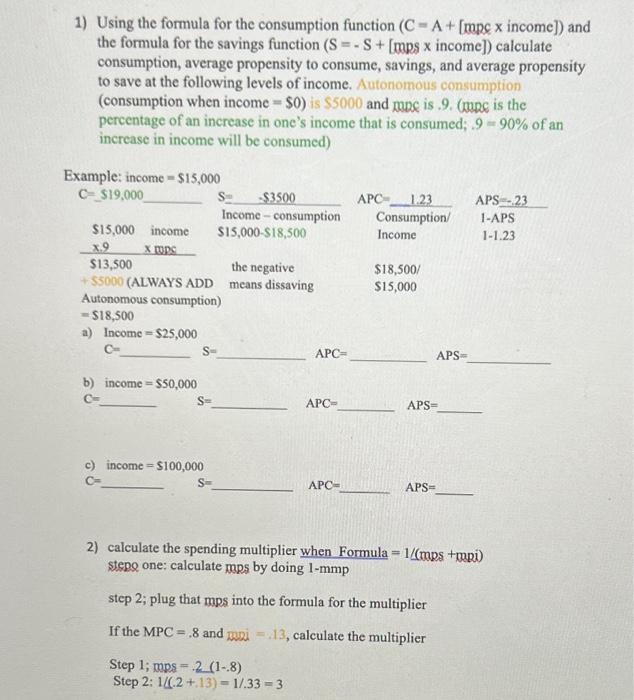

1) Using the formula for the consumption function ( income]) and the formula for the savings function income] calculate consumption, average propensity to consume, savings, and average propensity to save at the following levels of income. Autonomous consumption (consumption when income ) is and mupe is .9. (mope is the percentage of an increase in one's income that is consumed; of an increase in income will be consumed) Example: income \begin{tabular}{|c|c|c|c|} \hline & & & APS \\ \hline \begin{tabular}{l} income \\ wos \\ \end{tabular} & \begin{tabular}{l} Income - consumption \\ \end{tabular} & \begin{tabular}{l} Consumption/ \\ Income \end{tabular} & \begin{tabular}{l} 1-APS \\ \end{tabular} \\ \hline & the negative & & \\ \hline \begin{tabular}{l} (ALWAYS ADD \\ Autonomous consumption \end{tabular} & means dissaving & & \\ \hline \end{tabular} a) Income APS= b) income APS= c) income APS= 2) calculate the spending multiplier when Formula mps + mpi) stepe one: calculate mps by doing 1 -mmp step 2; plug that mps into the formula for the multiplier If the and , calculate the multiplier Step Step

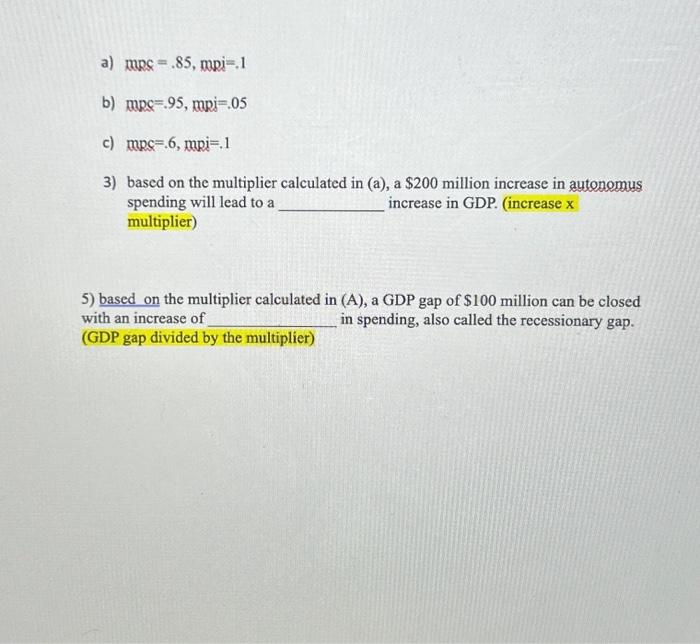

a) , b) c) , 3) based on the multiplier calculated in (a), a million increase in autenomus spending will lead to a increase in GDP. (increase multiplier) 5) based on the multiplier calculated in (A), a GDP gap of million can be closed with an increase of (GDP gap divided by the multiplier) in spending, also called the recessionary gap.