Home /

Expert Answers /

Accounting /

3-ch03-financial-planning-exercise-5-chapter-3-financial-planning-exercise-5-calculating-taxabl-pa438

(Solved): 3. Ch03 Financial Planning Exercise 5 Chapter 3 Financial Planning Exercise 5 Calculating taxabl ...

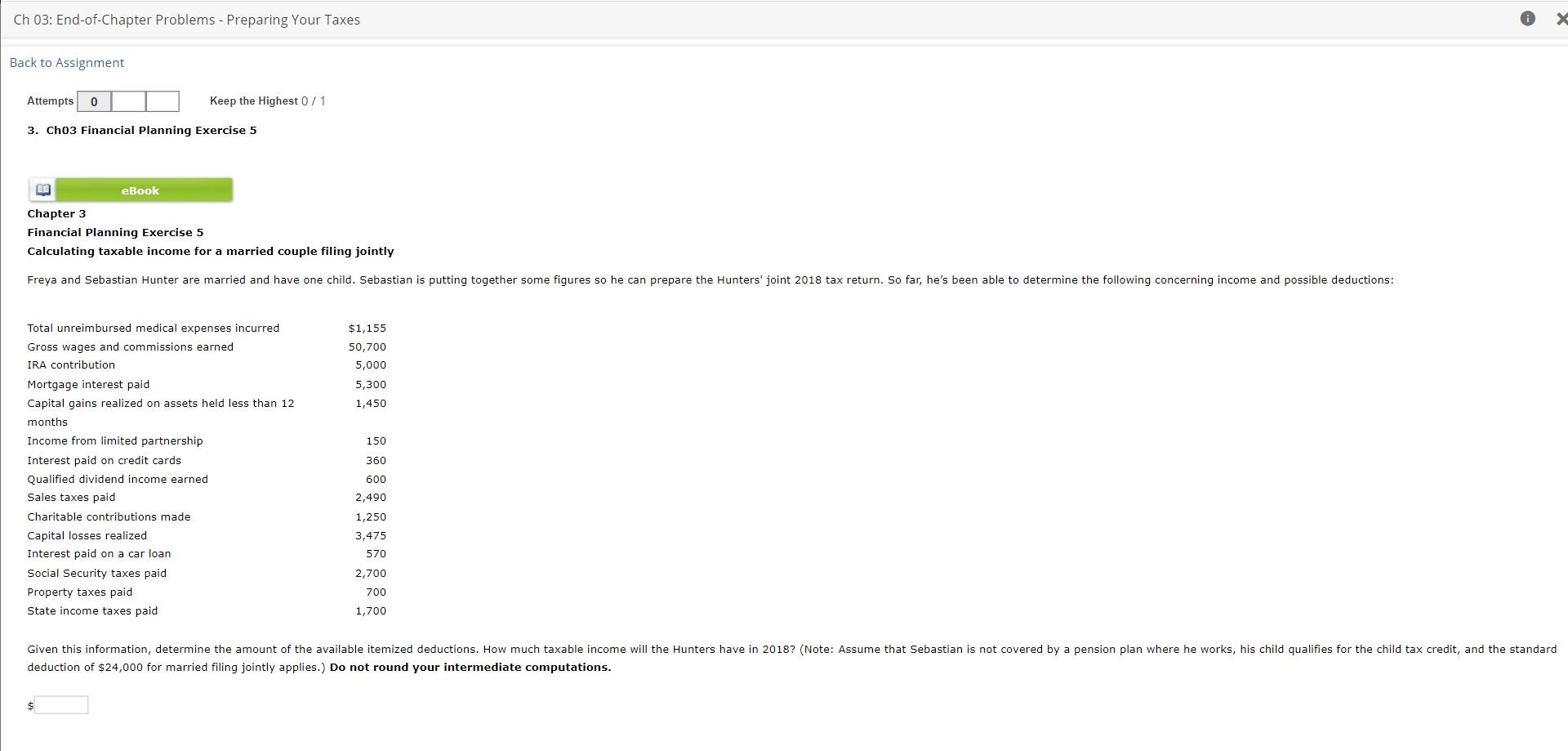

3. Ch03 Financial Planning Exercise 5 Chapter 3 Financial Planning Exercise 5 Calculating taxable income for a married couple filing jointly deduction of \( \$ 24,000 \) for married filing jointly applies.) Do not round your intermediate computations.

Financial Planning Exercise 7 Effect of tax credit vs. tax exemption After-tax income with tax deduction \$\$ After-tax income with tax credit \( \$ \)

Expert Answer

Answer:- 5) . Computation of Hunter's taxable income Amount ($) Amount ($) Gross wages and commission earned 50,700 Qualified dividend income earned 600 Capital gain realized on assets 1,450 Income from limited partnership 150 Less: Capital losses re