(Solved): 3) Cash flow from financing activities has been fairly steady, and slightly negative, througho ...

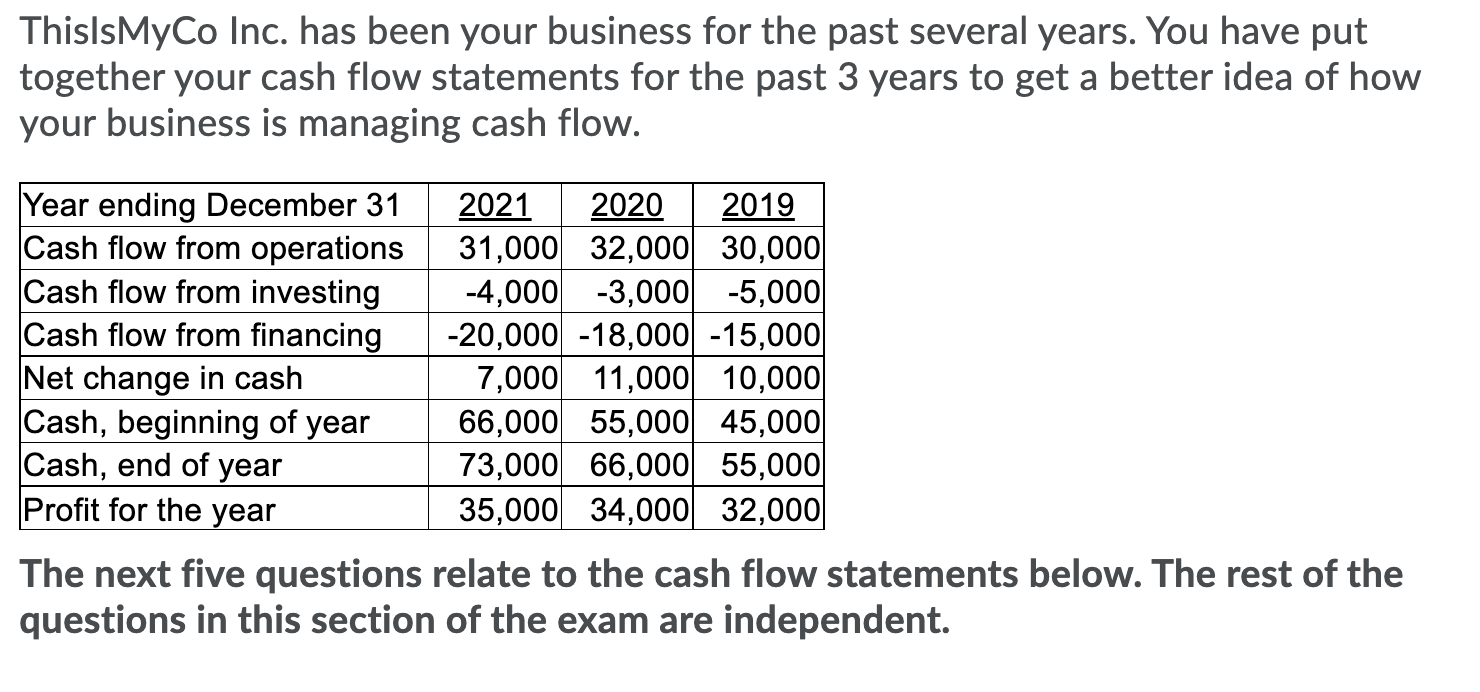

3) Cash flow from financing activities has been fairly steady, and slightly negative, throughout this period. Which of the following transactions can cause financing cash flow to be negative?

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

4) Which type of financial ratio can be calculated from both income statement and balance sheet figures?

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

5). Which type of financial ratio tells you how well a company can cover its long-term liabilities?

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

6) Which type of financial ratio tells you how well a company can cover its current liabilities?

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

7) Which of the following is a liquidity ratio?

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

8) In a horizontal analysis of an income statement, what is the correct formula to calculate the percentages?

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

9) In a vertical analysis of a balance sheet, what is the correct formula to calculate the percentages?

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

10). A vertical analysis of an income statement tells you

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

11). A horizontal analysis of a balance sheet tells you

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

Expert Answer

1 answer will be purchase of long-lived assets purchase has negative impact on cash flow 2 answer will be profitability and efficiency examp