Home /

Expert Answers /

Finance /

5-7-your-firm-is-considering-investing-in-a-project-to-redose-sosts-by-556-000-annually-the-pa699

(Solved): 5-7. Your firm is considering investing in a project to redose sosts by \( 556.000 \) annually. The ...

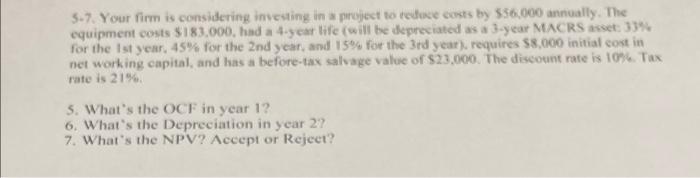

5-7. Your firm is considering investing in a project to redose sosts by \( 556.000 \) annually. The equipment costs \( \$ 183.000 \), had a 4-year tife (will be depreciated as a 3-year MACRS asset: 33\% for the Ist year. \( 45 \% \) for the 2 nd year, and \( 15 \% \) for the 3rd year), requires \( \$ 8,000 \) initial cost in net working capital, and has a before-tax salvage value of \( \$ 23,000 \). The discotint nate is 1006 . Tax rate is \( 21 \% 6 \). 5. What's the OCF in year 1 ? 6. What's the Depreciation in year 2? 7. What's the NPV? Accept or Reject?

Expert Answer

Statement showing depreciation and book value of equipment at end of year 3 Year Opening balance Depreciation rates Depreciation = cost