(Solved): 5. For the following forecasted data of firm A1 WebStores Pvt. Ltd, calculate the intrinsic value of ...

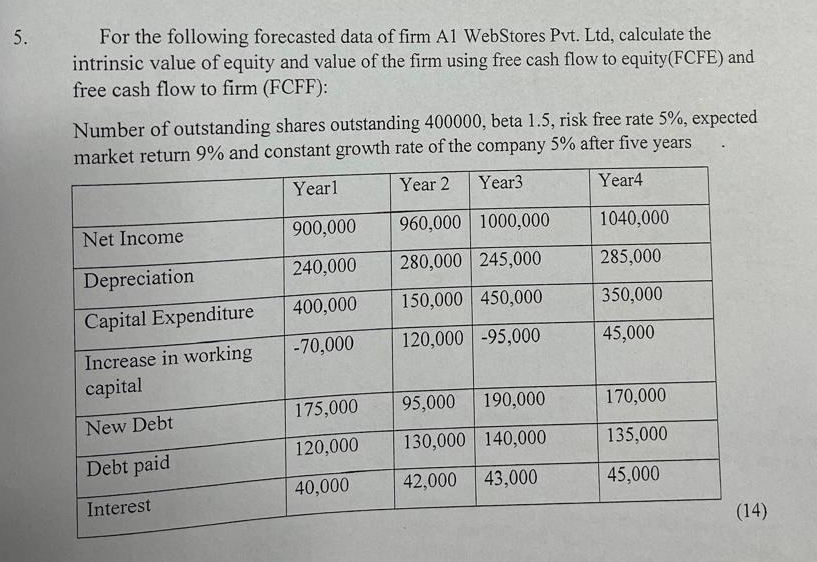

5. For the following forecasted data of firm A1 WebStores Pvt. Ltd, calculate the intrinsic value of equity and value of the firm using free cash flow to equity(FCFE) and free cash flow to firm (FCFF): Number of outstanding shares outstanding 400000 , beta 1.5 , risk free rate \( 5 \% \), expected market return \( 9 \% \) and constant growth rate of the company \( 5 \% \) after five years \begin{tabular}{|l|l|l|l|l|} \hline & Year1 & Year 2 & Year3 & Year4 \\ \hline Net Income & 900,000 & 960,000 & 1000,000 & 1040,000 \\ \hline Depreciation & 240,000 & 280,000 & 245,000 & 285,000 \\ \hline Capital Expenditure & 400,000 & 150,000 & 450,000 & 350,000 \\ \hline \begin{tabular}{l} Increase in working \\ capital \end{tabular} & \( -70,000 \) & 120,000 & \( -95,000 \) & 45,000 \\ \hline New Debt & 175,000 & 95,000 & 190,000 & 170,000 \\ \hline Debt paid & 120,000 & 130,000 & 140,000 & 135,000 \\ \hline Interest & 40,000 & 42,000 & 43,000 & 45,000 \\ \hline \end{tabular}