Home /

Expert Answers /

Economics /

7-amp-8-please-7-3-points-considering-an-interest-rate-of-8-and-a-planning-horizon-of-20-years-pa219

(Solved): 7&8 please 7. ( 3 points) Considering an interest rate of 8% and a planning horizon of 20 years, ...

7&8 please

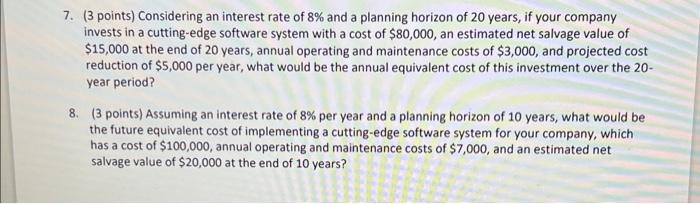

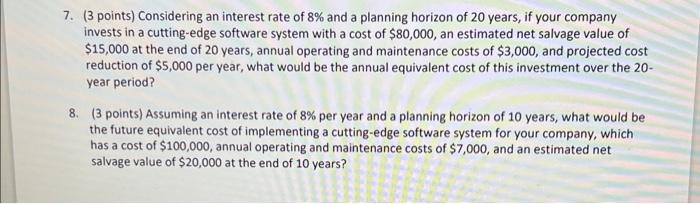

7. ( 3 points) Considering an interest rate of and a planning horizon of 20 years, if your company invests in a cutting-edge software system with a cost of , an estimated net salvage value of at the end of 20 years, annual operating and maintenance costs of , and projected cost reduction of per year, what would be the annual equivalent cost of this investment over the 20 year period? 8. (3 points) Assuming an interest rate of per year and a planning horizon of 10 years, what would be the future equivalent cost of implementing a cutting-edge software system for your company, which has a cost of , annual operating and maintenance costs of , and an estimated net salvage value of at the end of 10 years?

Expert Answer

ANSWER-7To calculate the annual equivalent cost of the investment over the 20-year period, we need to consider the initial cost, net salvage value, annual operating and maintenance costs, and projected cost reduction.Initial cost: $80,000Net salvage value: $15,000Annual operating and maintenance costs: $3,000Projected cost reduction: $5,000 per yearTo find the annual equivalent cost, we can use the annuity formula:Annual Equivalent Cost = Initial Cost - Net Salvage Value + Annual Operating and Maintenance Costs - Present Value of Projected Cost ReductionFirst, let's calculate the present value of the projected cost reduction using the interest rate and planning horizon:Present Value of Projected Cost Reduction = Annual Cost Reduction / (1 + Interest Rate)^YearsPresent Value of Projected Cost Reduction = $5,000 / (1 + 0.08)^20 Present Value of Projected Cost Reduction = $5,000 / (1.08)^20 Present Value of Projected Cost Reduction ? $5,000 / 4.66096 Present Value of Projected Cost Reduction ? $1,073.07Now, we can calculate the annual equivalent cost:Annual Equivalent Cost = $80,000 - $15,000 + $3,000 - $1,073.07 Annual Equivalent Cost ? $66,926.93Therefore, the annual equivalent cost of this investment over the 20-year period is approximately $66,926.93.