Home /

Expert Answers /

Accounting /

7-quad-ifrs-requires-extensive-use-of-fair-values-when-recording-the-acquisition-of-a-subsi-pa475

(Solved): \( 7 \quad \) IFRS requires extensive use of fair values when recording the acquisition of a subsi ...

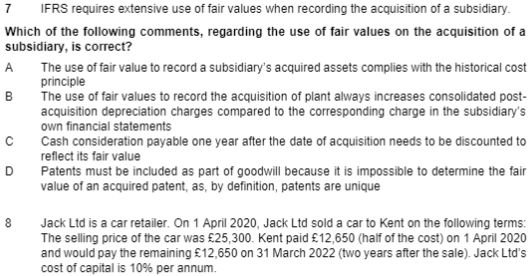

\( 7 \quad \) IFRS requires extensive use of fair values when recording the acquisition of a subsidiary. Which of the following comments, regarding the use of fair values on the acquisition of a subsidiary, is correct? A The use of fair value to record a subsidiary's acquired assets complies with the historical cost principle B The use of fair values to record the acquisition of plant always increases consolidated postacquisition depreciation charges compared to the corresponding charge in the subsidiary's own financial statements C Cash consideration payable one year after the date of acquisition needs to be discounted to reflect its fair value D Patents must be included as part of goodwill because it is impossible to determine the fair value of an acquired patent, as, by definition, patents are unique 8 Jack Ltd is a car retailer. On 1 April 2020, Jack Ltd sold a car to Kent on the following terms: The selling price of the car was \( £ 25,300 \). Kent paid \( £ 12,650 \) (half of the cost) on 1 April 2020 and would pay the remaining \( £ 12,650 \) on 31 March 2022 (two years after the sale). Jack Ltd's cost of capital is \( 10 \% \) per annum.