Home /

Expert Answers /

Finance /

a-3-year-project-is-expected-to-generate-annual-revenues-of-125-000-variable-costs-of-50-000-an-pa706

(Solved): A 3-year project is expected to generate annual revenues of $125,000, variable costs of $50,000, an ...

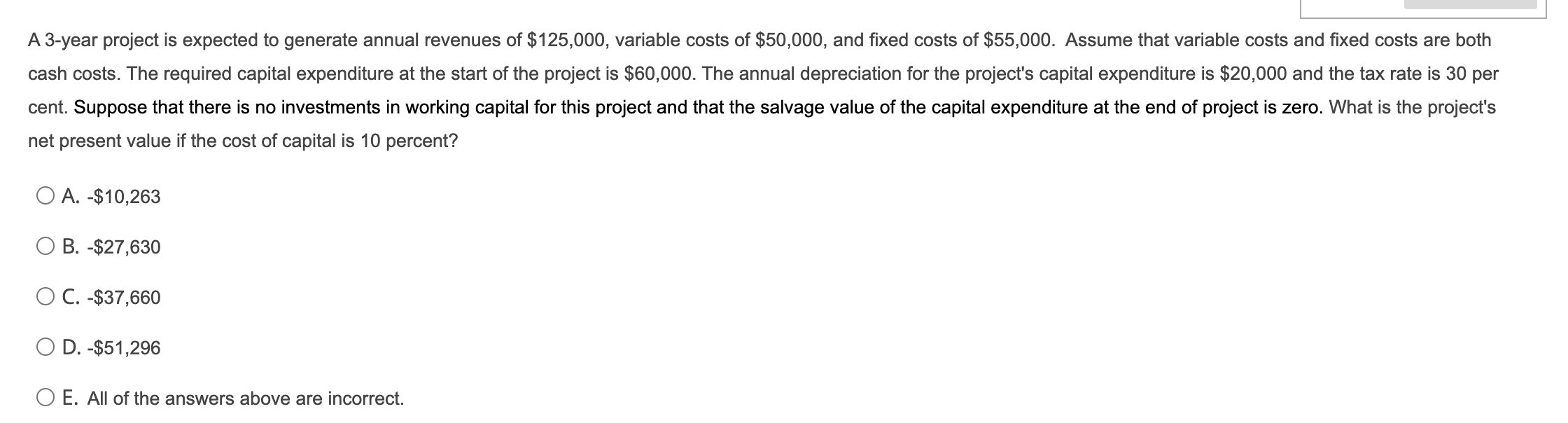

A 3-year project is expected to generate annual revenues of , variable costs of , and fixed costs of . Assume that variable costs and fixed costs are both cash costs. The required capital expenditure at the start of the project is . The annual depreciation for the project's capital expenditure is and the tax rate is 30 per cent. Suppose that there is no investments in working capital for this project and that the salvage value of the capital expenditure at the end of project is zero. What is the project's net present value if the cost of capital is 10 percent? A. B. C. D. E. All of the answers above are incorrect.

Expert Answer

Answer: Option (a) -10263 is the correct answer.The cash flows must be discounted to their present value, and the initial investment must be subtracted, in order to calculate the project's net present value (NPV). Given data: Annual revenues: $125,000 Variable costs: $50,000 Fixed costs: $55,000 Capital expenditure: $60,000 Annual depreciation: $20,000 Tax rate: 30% Cost of capital: 10% We calculate the project's yearly cash flows as follows: Operating cash flow = (Annual revenues - Variable costs - Fixed costs) × (1 - Tax rate) = ($125,000 - $50,000 - $55,000) × (1 - 0.30) = $20,000