Home /

Expert Answers /

Finance /

a-firm-evaluates-all-of-its-projects-by-applying-the-npv-decision-nile-a-propect-under-consideratio-pa153

(Solved): A firm evaluates all of its projects by applying the NPV decision nile. A propect under consideratio ...

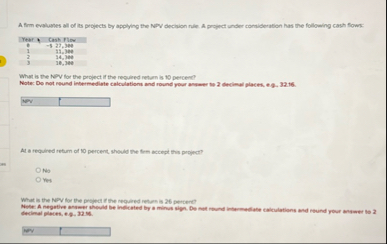

A firm evaluates all of its projects by applying the NPV decision nile. A propect under consideration has the following cash flows: \table[[41tt,Cust],[b,- 1],[1,11.30e],[2,14.398],[5,17,304]] What is the NeV flor the project if the reculred return is 10 percenc? Note: De not reund intermediate calculations and round pour answer to 2 devisul places, e.g. 32.16 .

◻NP At a required return of 10 percent, should the firm accept this project?

◻No

◻Nes What is the NPV for the project if the requered returs is 26 percent? decimal playes, e. p. - 32 is

◻nev