Home /

Expert Answers /

Operations Management /

a-hedge-fund-believes-that-starbucks-is-going-to-outperform-dunkin-donuts-another-coffee-donut-sh-pa819

(Solved): A hedge fund believes that Starbucks is going to outperform Dunkin Donuts (another coffee/donut sh ...

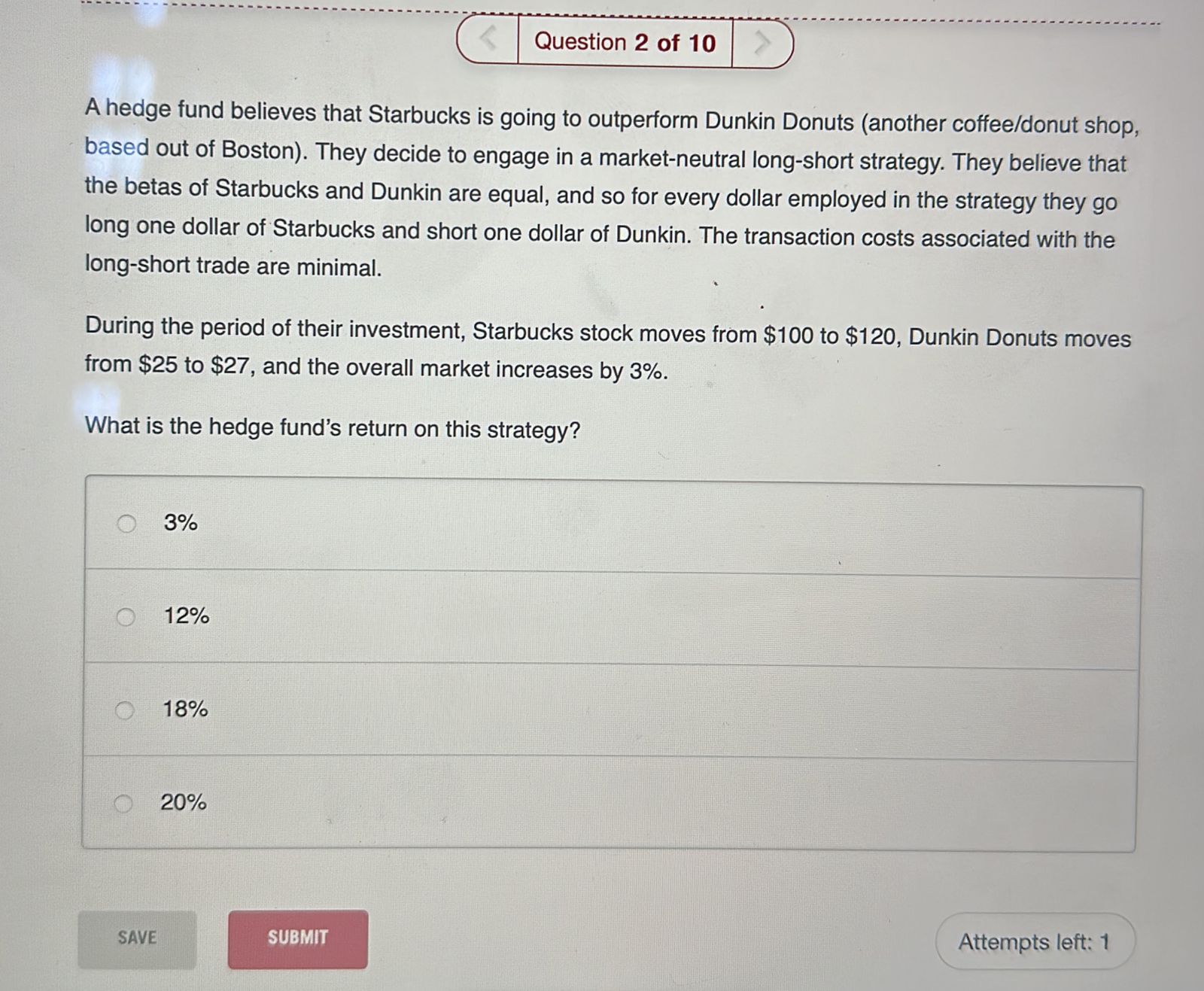

A hedge fund believes that Starbucks is going to outperform Dunkin Donuts (another coffee/donut shop, based out of Boston). They decide to engage in a market-neutral long-short strategy. They believe that the betas of Starbucks and Dunkin are equal, and so for every dollar employed in the strategy they go long one dollar of Starbucks and short one dollar of Dunkin. The transaction costs associated with the long-short trade are minimal. During the period of their investment, Starbucks stock moves from to , Dunkin Donuts moves from to , and the overall market increases by . What is the hedge fund's return on this strategy?