Home /

Expert Answers /

Finance /

a-stock-has-an-expected-return-of-18-percent-and-a-beta-of-1-4-the-risk-free-rate-is-1-5-pe-pa128

(Solved): A stock has an expected return of 18 percent and a beta of 1.4. The risk-free rate is \( 1.5 \) pe ...

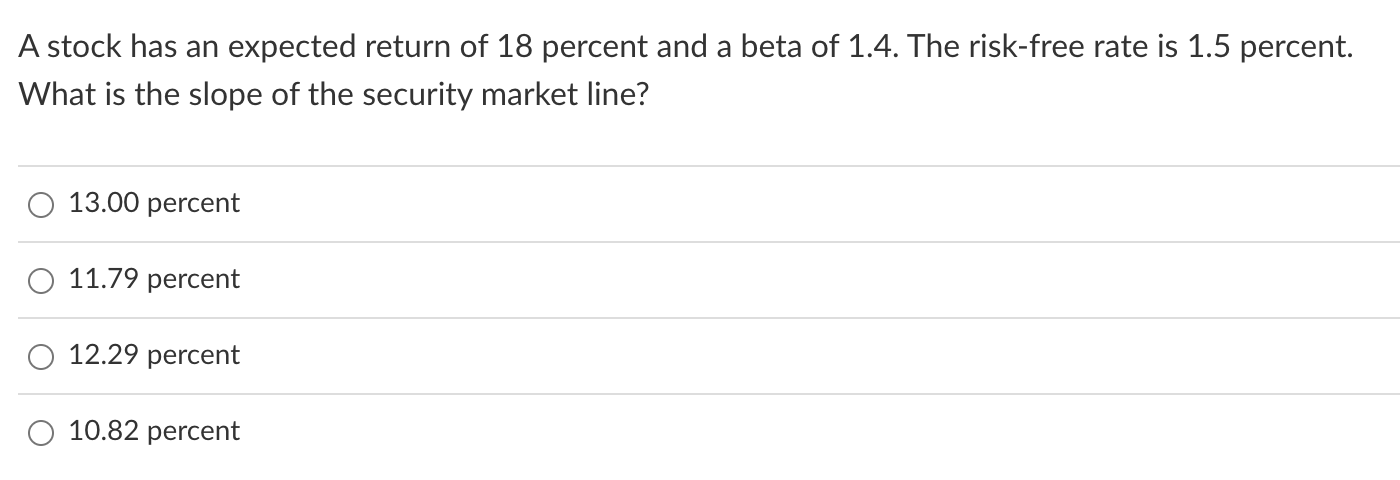

A stock has an expected return of 18 percent and a beta of 1.4. The risk-free rate is \( 1.5 \) percent. What is the slope of the security market line? \( 13.00 \) percent \( 11.79 \) percent \( 12.29 \) percent \( 10.82 \) percent

Expert Answer

Correct Answer : Slope of security market line is 11.79% Explanation : Calculation of Slope of the security market line : Step 1