Home /

Expert Answers /

Finance /

a-stock-sells-for-100-in-the-market-the-company-39-s-beta-is-1-6-the-market-risk-premium-rm-pa216

(Solved): A stock sells for $100 in the market. The company's beta is 1.6 , the market risk premium (rM ...

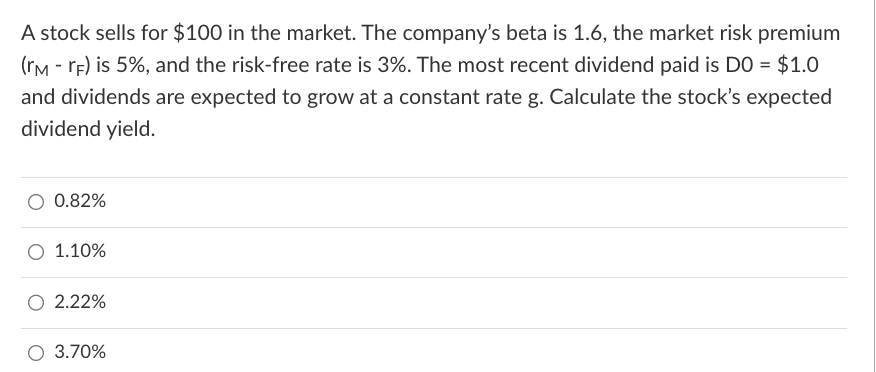

A stock sells for in the market. The company's beta is 1.6 , the market risk premium is , and the risk-free rate is . The most recent dividend paid is D0 and dividends are expected to grow at a constant rate g. Calculate the stock's expected dividend yield.

Expert Answer

Here,Market price (P) = $100Beta = 1.6Dividend paid (D0) = $1Maarket risk premium (MRp) = 5%Risk f...