Home /

Expert Answers /

Accounting /

a-taxpayer-is-single-56-years-old-and-has-recently-begun-taking-distributions-from-their-401-pa714

(Solved): A taxpayer is Single, 56 years old, and has recently begun taking distributions from their ** 401 ...

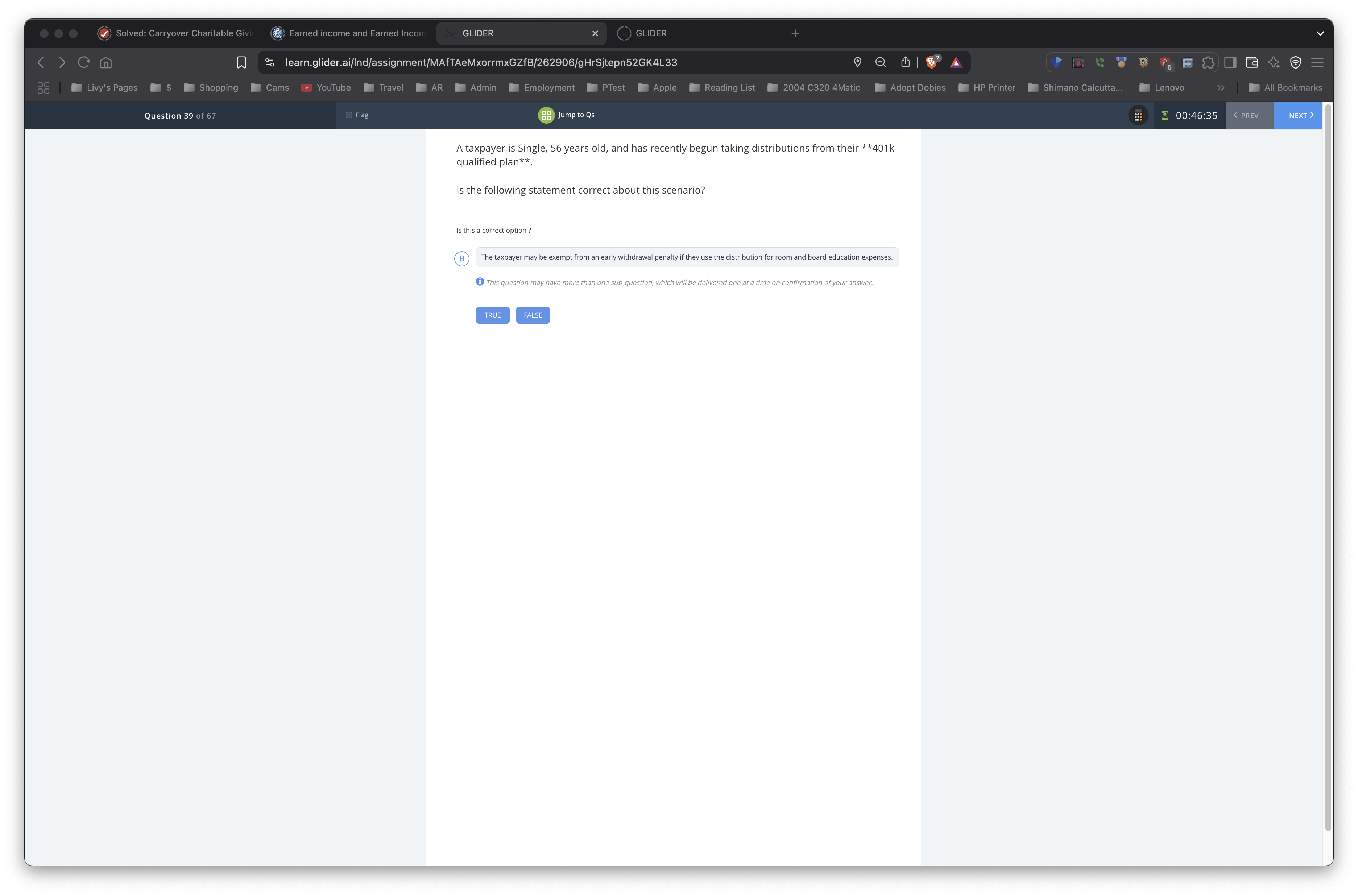

A taxpayer is Single, 56 years old, and has recently begun taking distributions from their ** 401 k qualified plan**. Is the following statement correct about this scenario? Is this a correct option? The taxpayer may be exempt from an early withdrawal penalty if they use the distribution for room and board education expenses. (1) This question may have more than one sub-question, which will be delivered one at a time on confirmation of your answer.