Home /

Expert Answers /

Accounting /

a-taxpayer-is-trading-in-an-automobile-used-solely-for-business-purposes-for-another-automobile-to-pa498

(Solved): A taxpayer is trading in an automobile used solely for business purposes for another automobile to ...

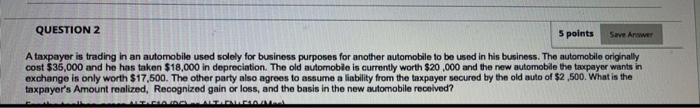

A taxpayer is trading in an automobile used solely for business purposes for another automobile to be used in his business. The automobile originally cost \( \$ 35,000 \) and he has taken \( \$ 18,000 \) in depreciation. The old automobie is currently worth \( \$ 20,000 \) and the new automobile the taxpayer wants in exchange is only worth \( \$ 17,500 \). The other party also agrees to assume a liability from the taxpayer secured by the old aulo of \( \$ 2 \), 500 . What is the taxpayer's Amount realized, Recognized gain or loss, and the basis in the new automobile recelved?

Expert Answer

1. Gain/Loss Realized Gain/Loss Realized = Amount Realized – Adjusted Basis of Auto Given Up – Cash Paid = $17