Home /

Expert Answers /

Accounting /

all-parts-or-dont-answer-thank-you-b-using-the-rounded-amount-from-part-a-in-your-computation-det-pa420

(Solved): all parts or dont answer thank you b. Using the rounded amount from Part a in your computation, det ...

all parts or dont answer thank you

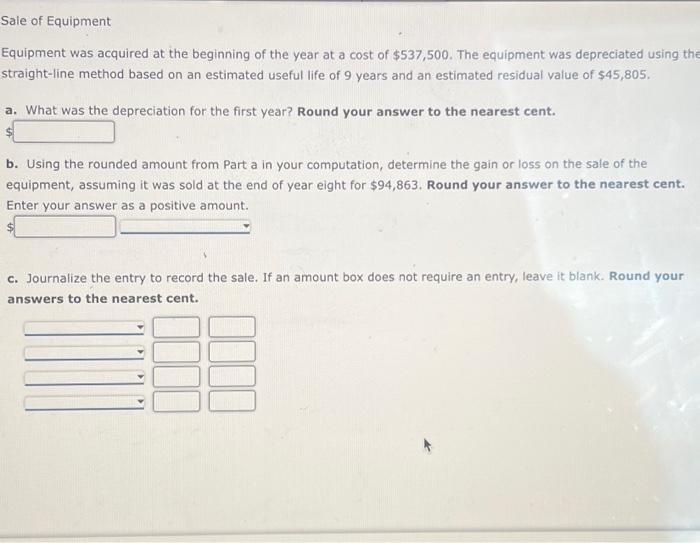

b. Using the rounded amount from Part a in your computation, determine the gain or loss on the sale of the equipment, assuming it was sold at the end of year eight for . Round your answer to the nearest cent. Enter your answer as a positive amount. c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent.

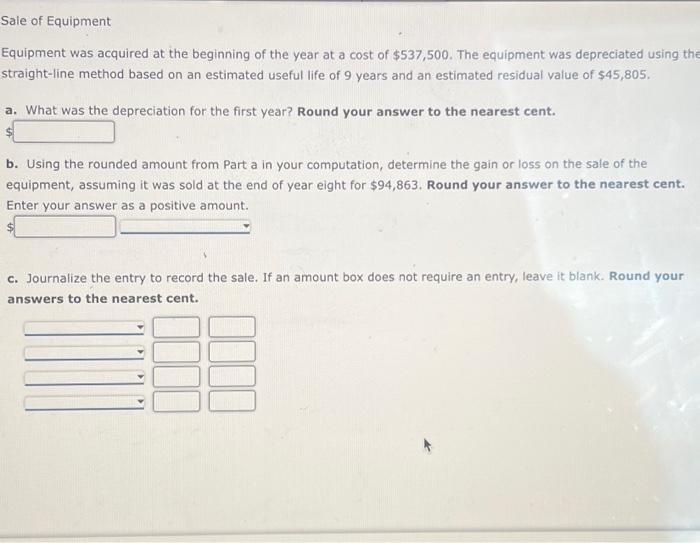

Current Liabilities Bon Nebo Co. sold 14,000 annual subscriptions of Magazine for during December 20Y8. These new subscribers will receive monthly issues, beginning in January 20Y9. In addition, the business had taxable income of during the first calendar quarter of . The federal tax rate is . A quarterly tax payment will be made on April 12, . Prepare the Current Liabilities section of the balance sheet for Bon Nebo Co. on March 31, 20 Y.

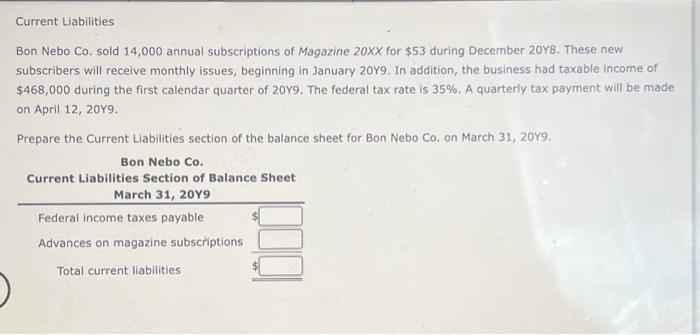

Cost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter.

Expert Answer

Sol:-1)a) Calculation of Depreciation for the first year:-Therefore, Depreciation for the first year = $107,500Depreciation for the first year = Beginning Year Equipment Cost x Double - Declining Method PercentageWorking Note:-Useful life = 10 yearsDouble declining depreciation rate = 2 x 1/10Double declining depreciation rate = 20%Double declining depreciation rate = 2 x 1/useful life