Home /

Expert Answers /

Chemistry /

allen-filed-his-2025-tax-return-on-may-15-th-2026-and-underreported-his-gross-income-by-30-perc-pa222

(Solved): Allen filed his 2025 tax return on May 15^(th ), 2026, and underreported his gross income by 30 perc ...

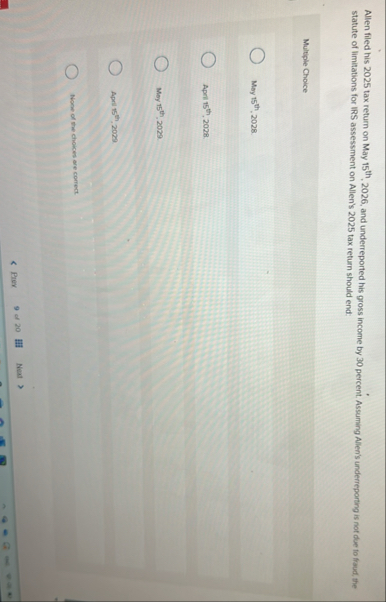

Allen filed his 2025 tax return on May

15^(th ), 2026, and underreported his gross income by 30 percent. Assuming Allen's underreporting is not due to froud, the statute of limitations for IRS assessment on Allen's 2025 tax return should end: Multiple Choice

_(_())_(_())Moy

15^(th ),2028.

_(_())_(_())Aprit 15t, 2028.

_(_())_(_())Moy

15^(th ),2029

_(_())_(_())April 15* 2029

_(_())_(_())None of the choices are correct. Prev 9 of 20 Nual