Home /

Expert Answers /

Statistics and Probability /

an-issue-that-faces-individuals-investing-for-retirement-is-allocating-assets-among-different-invest-pa887

(Solved): An issue that faces individuals investing for retirement is allocating assets among different invest ...

An issue that faces individuals investing for retirement is allocating assets among different investment choices. Suppose a study conducted 10 years ago showed that

65?%

of investors preferred stocks to real estate as an investment. In a recent random sample of

1,000

?investors,

400

preferred real estate to stocks? (equivalently,

600

preferred stocks to real? estate). Is this new data sufficient to conclude that the proportion of investors preferring stocks to real estate has declined from 10 years? ago? Conduct the analysis at the

?=0.02

level of significance.

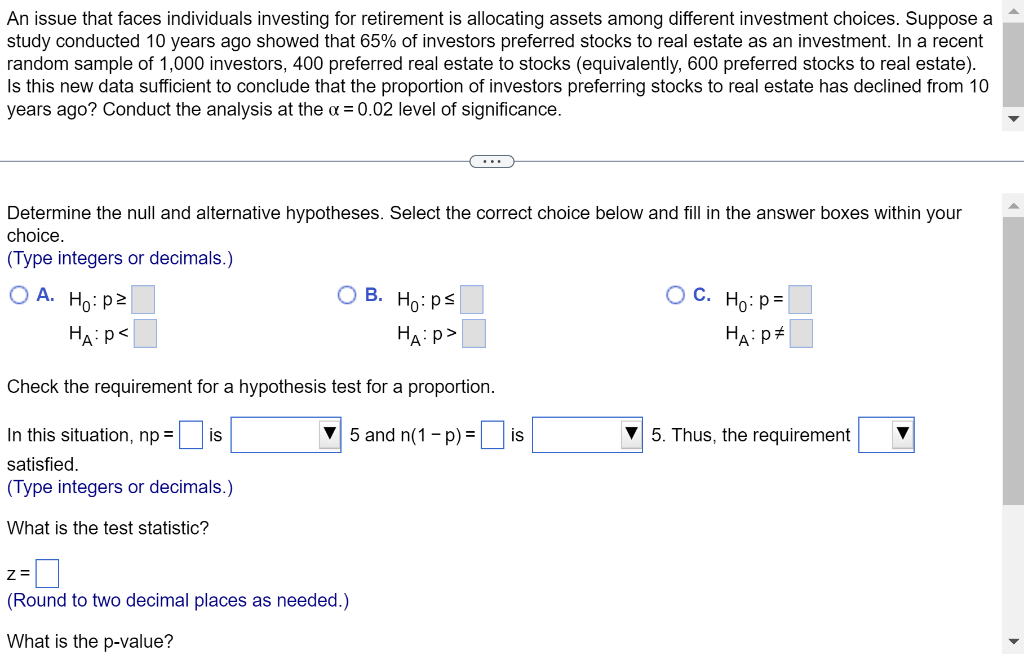

An issue that faces individuals investing for retirement is allocating assets among different investment choices. Suppose a study conducted 10 years ago showed that 65% of investors preferred stocks to real estate as an investment. In a recent random sample of 1,000 investors, 400 preferred real estate to stocks (equivalently, 600 preferred stocks to real estate). Is this new data sufficient to conclude that the proportion of investors preferring stocks to real estate has declined from 10 years ago? Conduct the analysis at the x = 0.02 level of significance. Determine the null and alternative hypotheses. Select the correct choice below and fill in the answer boxes within your choice. (Type integers or decimals.) OA. Ho: p² O C. Ho:p= OB. Ho: ps HA:P> HA:P< HA: P Check the requirement for a hypothesis test for a proportion. 5 and n(1-p) =is 5. Thus, the requirement In this situation, np= is satisfied. (Type integers or decimals.) What is the test statistic? Z= (Round to two decimal places as needed.) What is the p-value?