Home /

Expert Answers /

Accounting /

answer-all-parts-of-this-question-a-assume-an-interest-rate-of-9-6-percent-per-year-and-consider-pa202

(Solved): ANSWER ALL PARTS OF THIS QUESTION (a) Assume an interest rate of 9.6 percent per year and consider ...

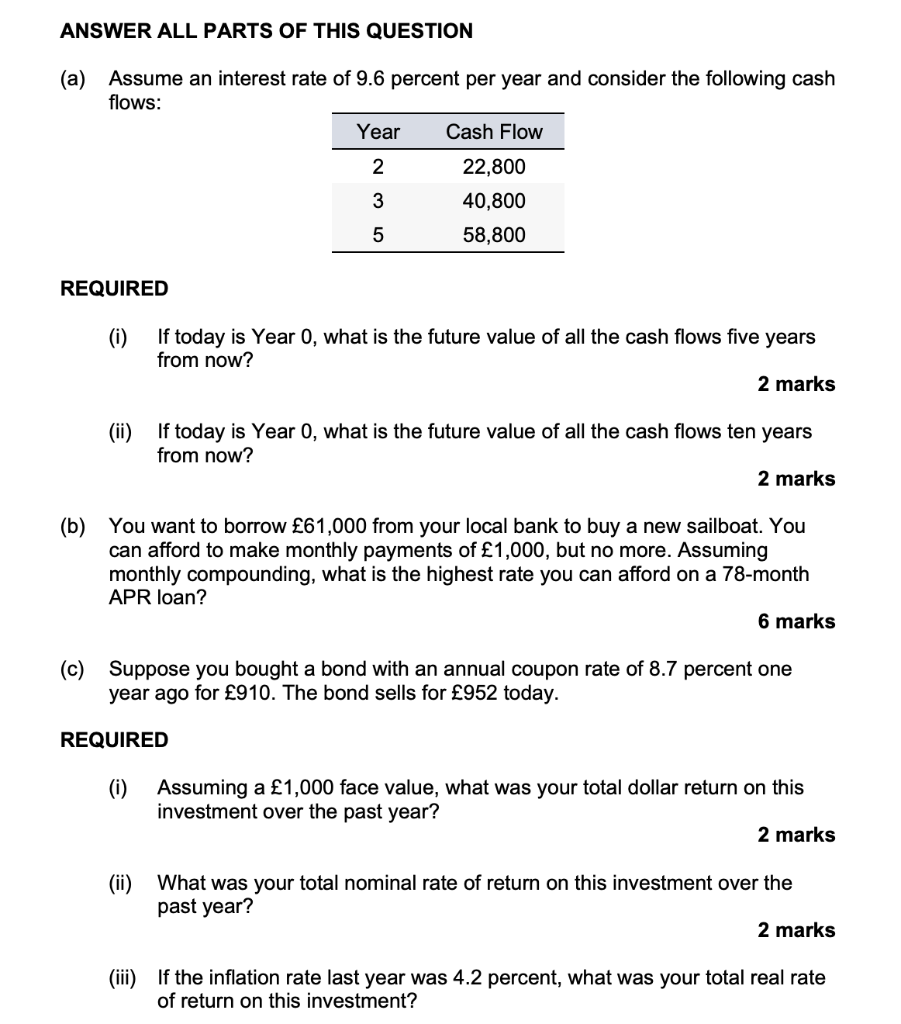

ANSWER ALL PARTS OF THIS QUESTION (a) Assume an interest rate of 9.6 percent per year and consider the following cash flows: Year Cash Flow 2 22,800 3 40,800 5 58,800 REQUIRED (i) If today is Year 0, what is the future value of all the cash flows five years from now? 2 marks (ii) If today is Year 0, what is the future value of all the cash flows ten years from now? 2 marks (b) You want to borrow £61,000 from your local bank to buy a new sailboat. You can afford to make monthly payments of £1,000, but no more. Assuming monthly compounding, what is the highest rate you can afford on a 78-month APR loan? 6 marks (c) Suppose you bought a bond with an annual coupon rate of 8.7 percent one year ago for £910. The bond sells for £952 today. REQUIRED (i) Assuming a £1,000 face value, what was your total dollar return on this investment over the past year? 2 marks (ii) What was your total nominal rate of return on this investment over the past year? 2 marks (iii) If the inflation rate last year was 4.2 percent, what was your total real rate of return on this investment?

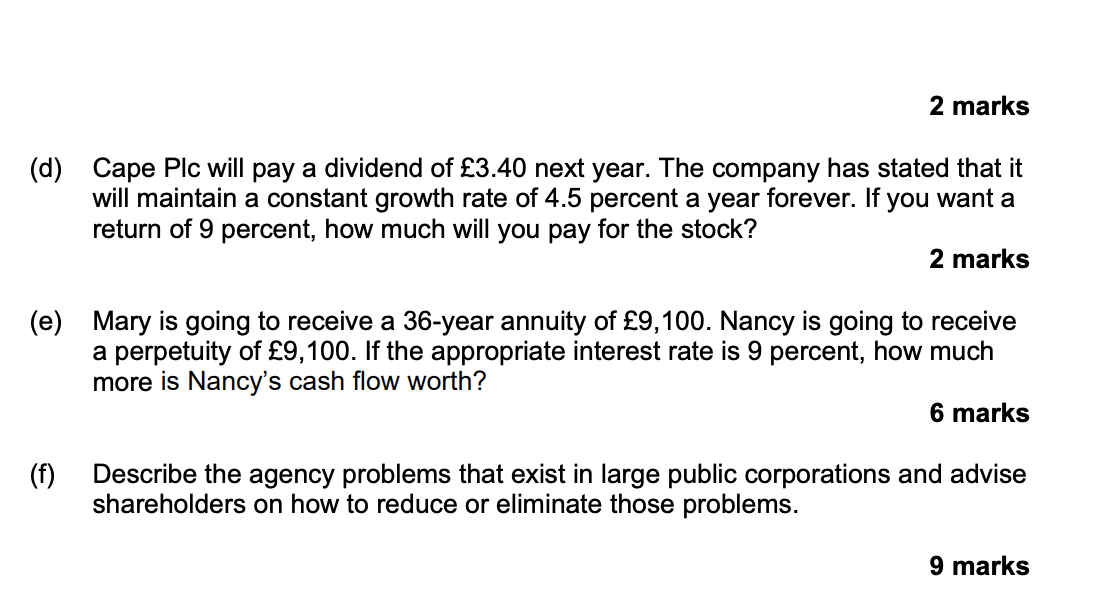

2 marks (d) Cape Plc will pay a dividend of £3.40 next year. The company has stated that it will maintain a constant growth rate of 4.5 percent a year forever. If you want a return of 9 percent, how much will you pay for the stock? 2 marks (e) Mary is going to receive a 36-year annuity of £9,100. Nancy is going to receive a perpetuity of £9,100. If the appropriate interest rate is 9 percent, how much more is Nancy's cash flow worth? 6 marks (f) Describe the agency problems that exist in large public corporations and advise shareholders on how to reduce or eliminate those problems. 9 marks

Expert Answer

Answer (a). (i) Year Cash Flow Compounding Future Cash