(Solved): Assume a continuously compounding dollar interest rate of 5% for all maturities, whenever applicable ...

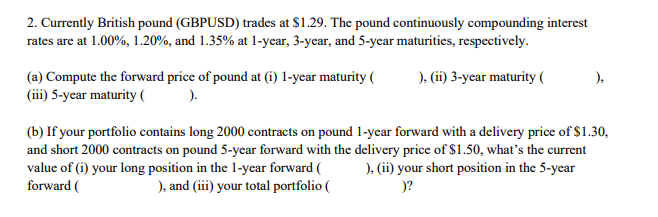

Assume a continuously compounding dollar interest rate of 5% for all maturities, whenever applicable. Currently British pound (GBPUSD) trades at $1.29. The pound continuously compounding interest rates are at 1.00%,1.20%, and 1.35% at 1-year, 3-year, and 5-year maturities, respectively. (a) Compute the forward price of pound at (i) 1-year maturity ( ), (ii) 3-year maturity ( ), (iii) 5-year maturity ). (b) If your portfolio contains long 2000 contracts on pound 1-year forward with a delivery price of $1.30, and short 2000 contracts on pound 5-year forward with the delivery price of $1.50, what's the current value of (i) your long position in the 1-year forward ( ), (ii) your short position in the 5 -year forward ), and (iii) your total portfolio ( ??