Home /

Expert Answers /

Finance /

assume-an-asset-price-s-t-follows-the-geometric-brownian-morion-d-s-t-mu-s-t-d-t-pa650

(Solved): Assume an asset price \( S_{t} \) follows the geometric Brownian morion, \( d S_{t}=\mu S_{t} d t+ ...

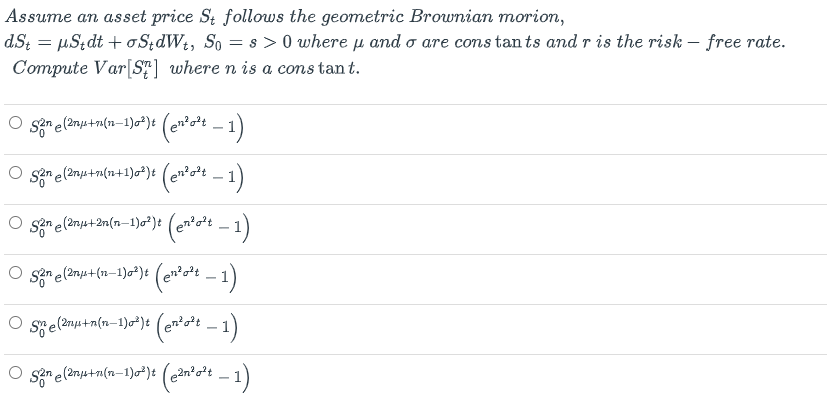

Assume an asset price \( S_{t} \) follows the geometric Brownian morion, \( d S_{t}=\mu S_{t} d t+\sigma S_{t} d W_{t}, S_{0}=s>0 \) where \( \mu \) and \( \sigma \) are cons \( \tan t s \) and \( r \) is the risk \( - \) free rate. Compute \( \operatorname{Var}\left[S_{t}^{n}\right] \) where \( n \) is a cons \( \tan t \). \[ \begin{array}{l} S_{0}^{2 n} e^{\left(2 n \mu+n(n-1) \sigma^{2}\right) t}\left(e^{n^{2} \sigma^{2} t}-1\right) \\ S_{0}^{2 n} e^{\left(2 n \mu+n(n+1) \sigma^{2}\right) t}\left(e^{n^{2} \sigma^{2} t}-1\right) \\ S_{0}^{2 n} e^{\left(2 n \mu+2 n(n-1) \sigma^{2}\right) t}\left(e^{n^{2} \sigma^{2} t}-1\right) \\ S_{0}^{2 n} e^{\left(2 n \mu+(n-1) \sigma^{2}\right) t}\left(e^{n^{2} \sigma^{2} t}-1\right) \\ S_{0}^{n} e^{\left(2 n \mu+n(n-1) \sigma^{2}\right) t}\left(e^{n^{2} \sigma^{2} t}-1\right) \\ S_{0}^{2 n} e^{\left(2 n \mu+n(n-1) \sigma^{2}\right) t}\left(e^{2 n^{2} \sigma^{2} t}-1\right) \end{array} \]