Home /

Expert Answers /

Accounting /

at-the-beginning-of-the-year-myrna-corporation-a-calendar-year-taxpayer-has-e-8-9-of-332-000-th-pa457

(Solved): At the beginning of the year, Myrna Corporation (a calendar year taxpayer) has E 8.9 of 332,000 . Th ...

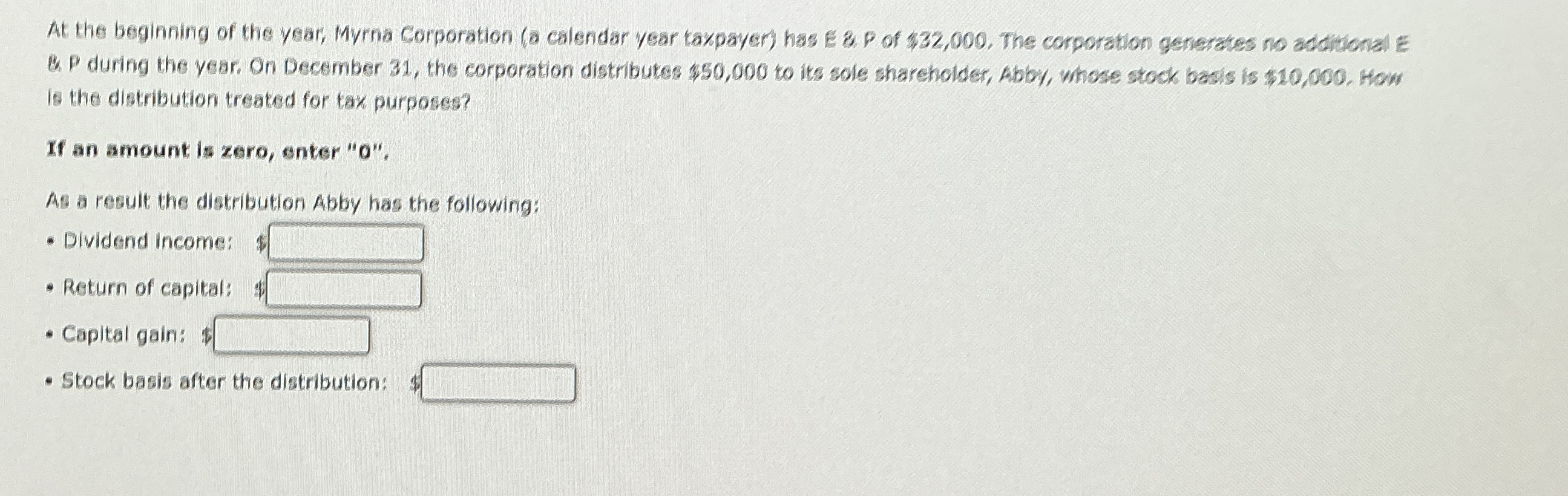

At the beginning of the year, Myrna Corporation (a calendar year taxpayer) has E 8.9 of 332,000 . The corporation generates no additional E Q. P during the year, On December 31, the corporation distributes

$50,000to its sole shareholder, Abby, whose stock basis is 510,000 . How Is the distribution treated for tax purposes? If an amount is zero, enter "0". As a result the dietribution Abby has the following: Dividend income:

◻Return of capital:

◻Capital gain: 1

◻Stock basis after the digtribution:

◻