(Solved): At the end of February, Matthews Productions accounting records reveal a balance for cash equal t ...

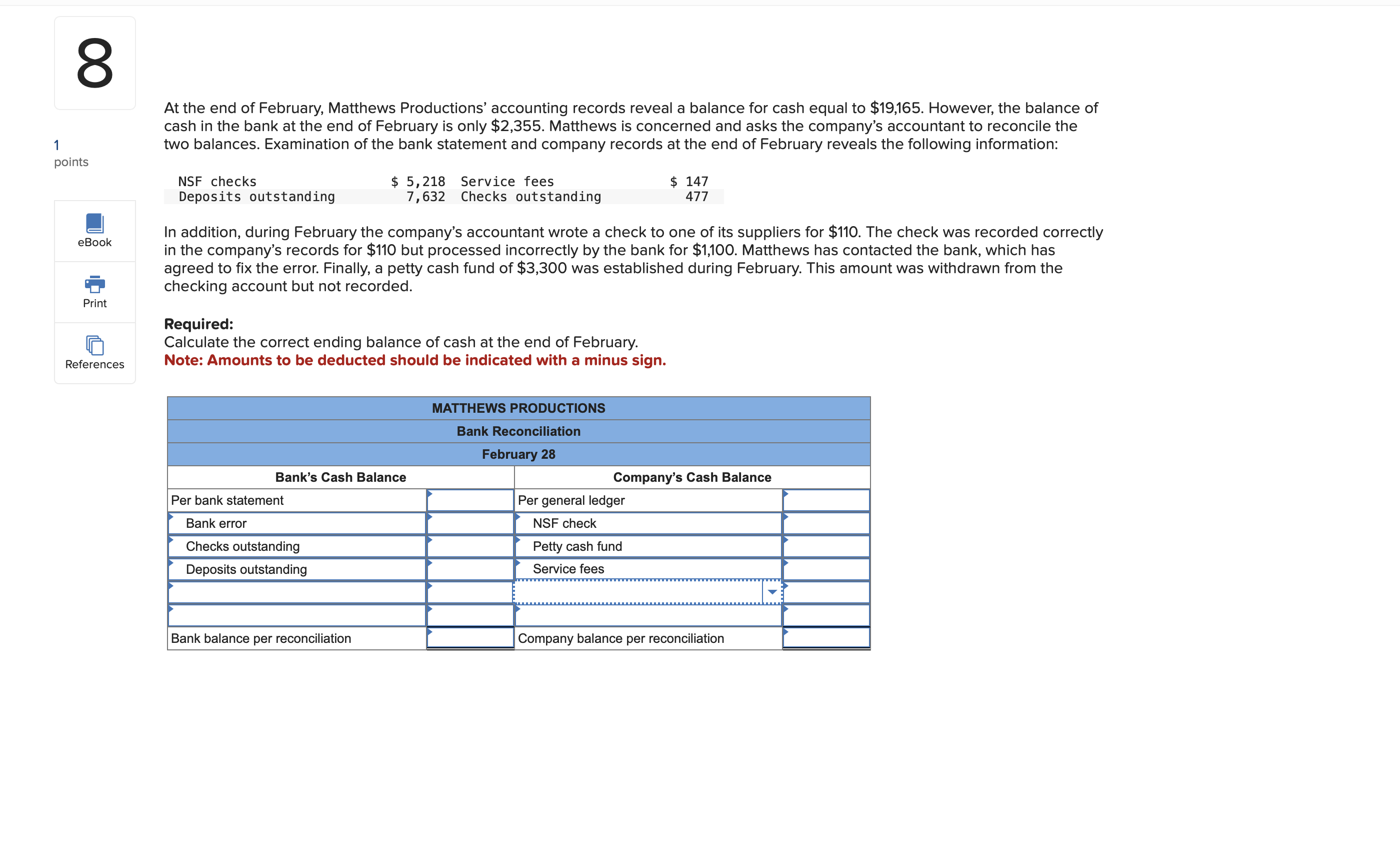

At the end of February, Matthews Productions’ accounting records reveal a balance for cash equal to $19,165. However, the balance of cash in the bank at the end of February is only $2,355. Matthews is concerned and asks the company’s accountant to reconcile the two balances. Examination of the bank statement and company records at the end of February reveals the following information: NSF checks$ 5,218 Service fees$ 147 Deposits outstanding 7,632 Checks outstanding 477 In addition, during February the company’s accountant wrote a check to one of its suppliers for $110. The check was recorded correctly in the company’s records for $110 but processed incorrectly by the bank for $1,100. Matthews has contacted the bank, which has agreed to fix the error. Finally, a petty cash fund of $3,300 was established during February. This amount was withdrawn from the checking account but not recorded.