Home /

Expert Answers /

Accounting /

baker-is-single-and-eamed-225-000-of-salary-as-an-employce-in-2022-how-much-should-his-emp-pa808

(Solved): Baker is single and eamed \( \$ 225.000 \) of salary as an employce in 2022 How much should his emp ...

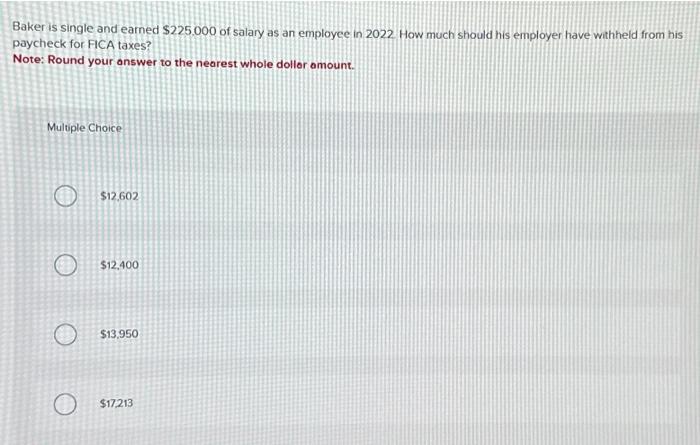

Baker is single and eamed \( \$ 225.000 \) of salary as an employce in 2022 How much should his employer have withheld from his paycheck for FICA taxes? Note: Round your answer to the nearest whole dollor amount. Multiple Choice \( \$ 12.602 \) \( \$ 12,400 \) \( \$ 13.950 \) \( \$ 17,213 \)

Expert Answer

Answer - Correct answer is $17,213 (last option). Its calculation is s