(Solved): Basic bond valuation Complex Systems has an outstanding issue of \( \$ 1,000 \)-par-value bonds with ...

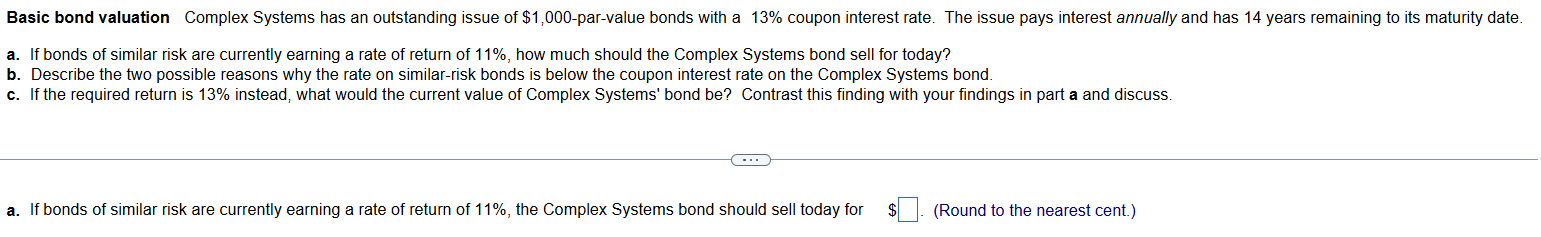

Basic bond valuation Complex Systems has an outstanding issue of \( \$ 1,000 \)-par-value bonds with a \( 13 \% \) coupon interest rate. The issue pays interest annually and has 14 years remaining to its maturity date. a. If bonds of similar risk are currently earning a rate of return of \( 11 \% \), how much should the Complex Systems bond sell for today? b. Describe the two possible reasons why the rate on similar-risk bonds is below the coupon interest rate on the Complex Systems bond. c. If the required return is \( 13 \% \) instead, what would the current value of Complex Systems' bond be? Contrast this finding with your findings in part a and discuss. a. If bonds of similar risk are currently earning a rate of return of \( 11 \% \), the Complex Systems bond should sell today for \( \$ \) . (Round to the nearest cent.)