Home /

Expert Answers /

Accounting /

calculate-social-security-taxes-medicare-taxes-and-fit-for-jordon-barrett-he-earns-a-monthly-sala-pa402

(Solved): Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly sala ...

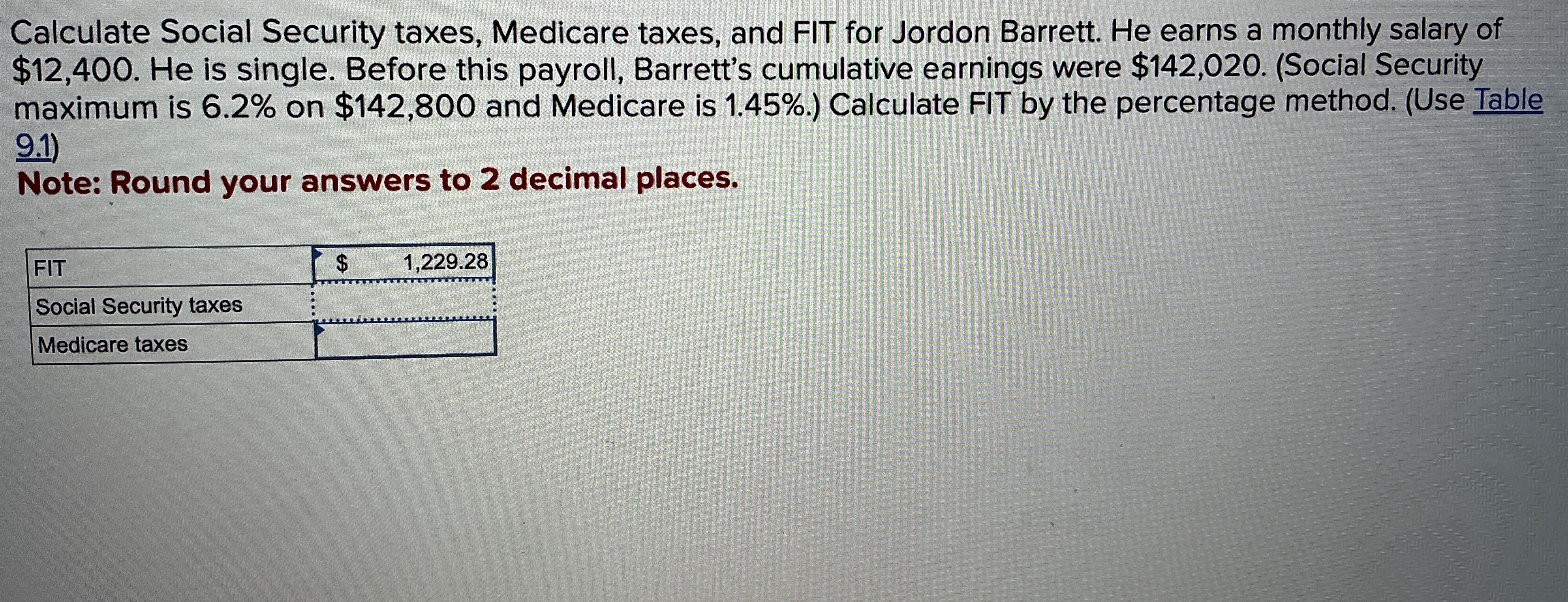

Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly salary of

$12,400. He is single. Before this payroll, Barrett's cumulative earnings were

$142,020. (Social Security maximum is

6.2%on

$142,800and Medicare is

1.45%.) Calculate FIT by the percentage method. (Use Table 9.1) Note: Round your answers to 2 decimal places. \table[[FIT,

$