Home /

Expert Answers /

Accounting /

celebration-travel-borrowed-61-000-on-october-1-2016-by-signing-a-one-year-note-payable-to-neighb-pa160

(Solved): Celebration Travel borrowed $61,000 on October 1, 2016, by signing a one-year note payable to Neighb ...

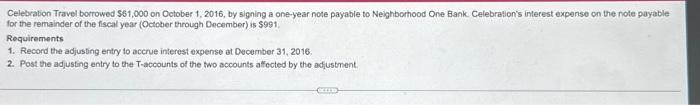

Celebration Travel borrowed $61,000 on October 1, 2016, by signing a one-year note payable to Neighborhood One Bank. Celebration's interest expense on the note payable for the remainder of the fiscal year (October through December) is $991. Requirements 1. Record the adjusting entry to accrue interest expense at December 31, 2016. 2. Post the adjusting entry to the T-accounts of the two accounts affected by the adjustment.

Celebrabion Travel borrowed on October 1,2016 , by signing a one-year note payable to Neighborhood One Bank. Celebration's interest expense on the note payable for the remainder of the fiscal year (October through Docomber) is . Requirements 1. Record the adjusting entry to accrue interest expense at December 31, 2016 . 2. Post the adjusting entry to the T-accounts of the two accounts affected by the adjustment.

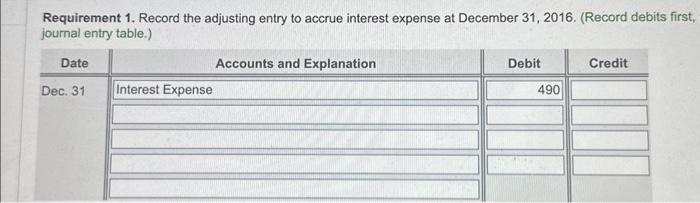

Requirement 1. Record the adjusting entry to accrue interest expense at December 31, 2016. (Record debits firs journal entry table.)

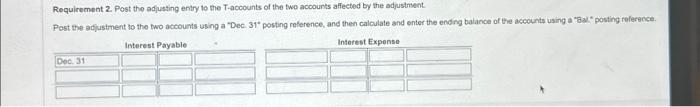

Requirement 2. Post the adjusting entry to the T-accounts of the two accounts affected by the adjustrvent.