(Solved): Compare the tax consequences of a taxable asset acquisition and a Type C asset-for-stock reorganizat ...

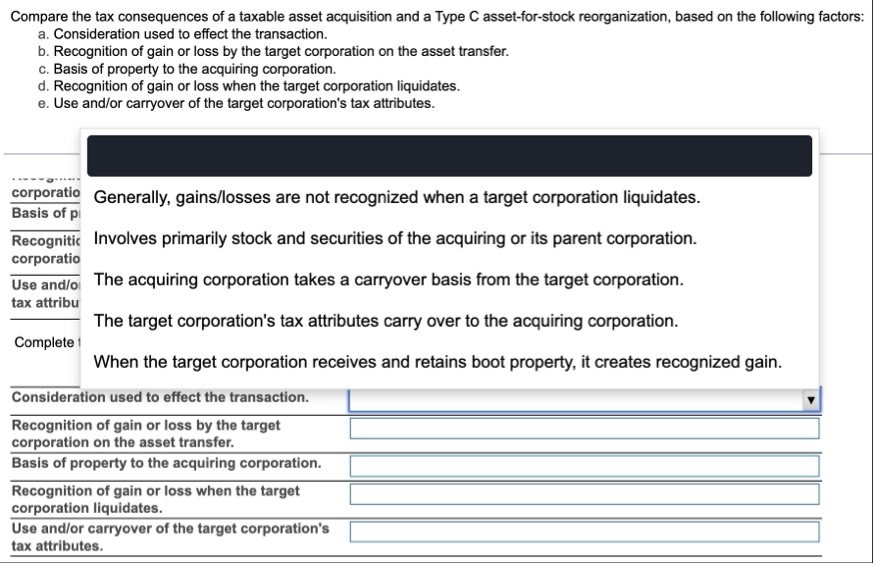

Compare the tax consequences of a taxable asset acquisition and a Type C asset-for-stock reorganization, based on the following factors: a. Consideration used to effect the transaction. b. Recognition of gain or loss by the target corporation on the asset transfer. c. Basis of property to the acquiring corporation. d. Recognition of gain or loss when the target corporation liquidates. e. Use and/or carryover of the target corporation's tax attributes. corporatio Basis of

pRecognitic corporatio Use and/o tax attribu Complete 1 Generally, gains/losses are not recognized when a target corporation liquidates. Involves primarily stock and securities of the acquiring or its parent corporation. The acquiring corporation takes a carryover basis from the target corporation. The target corporation's tax attributes carry over to the acquiring corporation. When the target corporation receives and retains boot property, it creates recognized gain. Consideration used to effect the transaction. Recognition of gain or loss by the target corporation on the asset transfer. Basis of property to the acquiring corporation.

◻Recognition of gain or loss when the target

◻corporation liquidates. Use and/or carryover of the target corporation's tax attributes.

◻