Home /

Expert Answers /

Accounting /

computing-depreciation-using-various-depreciation-methods-to-demonstrate-the-computations-involved-pa743

(Solved): Computing Depreciation Using Various Depreciation Methods To demonstrate the computations involved ...

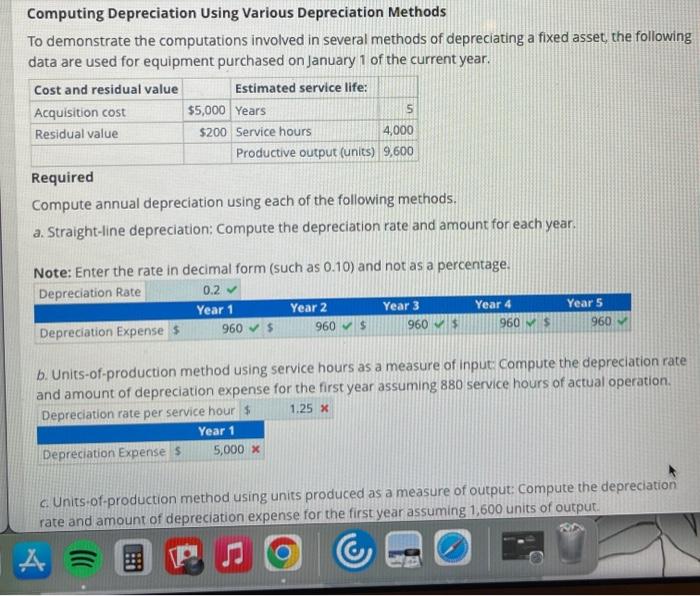

Computing Depreciation Using Various Depreciation Methods To demonstrate the computations involved in several methods of depreciating a fixed asset, the following data are used for equipment purchased on January 1 of the current year. Required Compute annual depreciation using each of the following methods. a. Straight-line depreciation: Compute the depreciation rate and amount for each year. Note: Enter the rate in decimal form (such as 0.10 ) and not as a percentage. b. Units-of-production method using service hours as a measure of input compute the depreciation rate and amount of depreciation expense for the first year assuming 880 service hours of actual operation. Deoreciation rate per service hour c. Units-of-production method using units produced as a measure of output: compute the depreciation cate and amount of depreciation expense for the first year assuming 1,600 units of output.

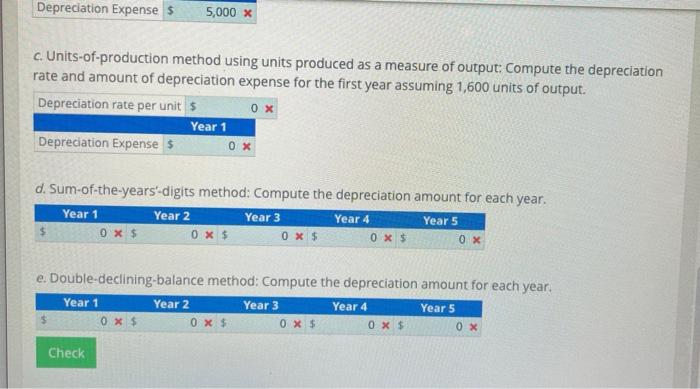

c. Units-of-production method using units produced as a measure of output: Compute the depreciation rate and amount of depreciation expense for the first year assuming 1,600 units of output. d. Sum-of-the-years'-digits method: Compute the depreciation amount for each year. e. Double-declining-balance method: Compute the depreciation amount for each year.