(Solved): Consider a student loan of $22,500 at a fixed APR of 12% for 20 years. a. Calculate the monthly paym ...

Consider a student loan of

$22,500at a fixed APR of

12%for 20 years. a. Calculate the monthly payment. b. Determine the total amount paid over the term of the loan. c. Of the total amount paid, what percentage is paid toward the principal and what percentage is paid for interest. a. The monthly payment is

$(Do not round until the final answer. Then round to the nearest cent as needed.) b. The total payment over the term of the loan is : (Round to the nearest cent as needed.) c. Of the total payment over the term of the loan,

◻interest. (Round to the nearest tenth as needed.) Decide whether you should itemize your deductions or take the standard deduction in the following case. State how much the better option will save you. Assume the standard deduction is

$25,100. Your filing status is married filing jointly. Your deductible expenditures are

$6900for interest on a home mortgage,

$2100for contributions to charity, and

$2525for state and local taxes. You should (1

◻for a savings of

$

◻in taxable income. (Simplify your answer.) (1)

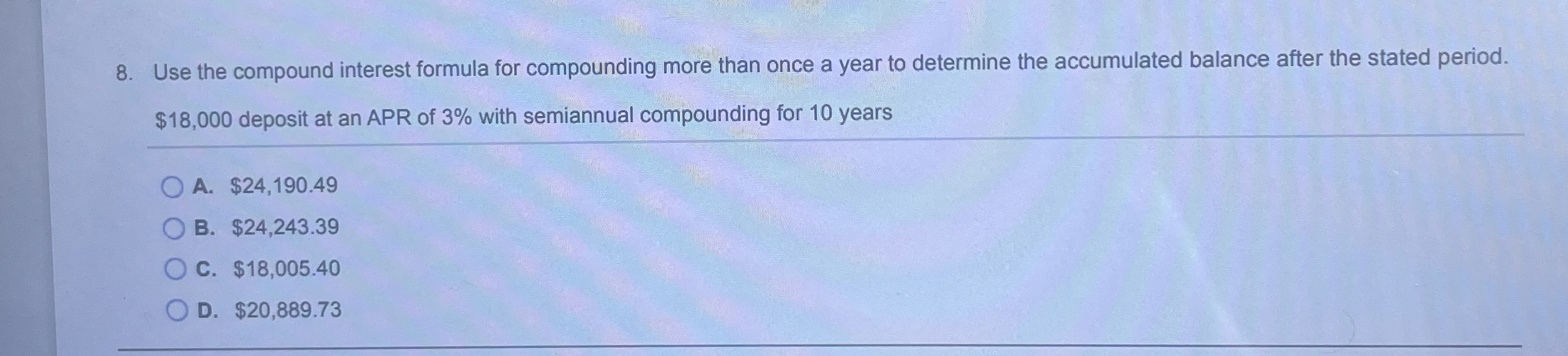

◻itemize your deductions claim the standard deduction Use the compound interest formula for compounding more than once a year to determine the accumulated balance after the stated period.

$18,000deposit at an APR of

3%with semiannual compounding for 10 years A.

$24,190.49B.

$24,243.39C.

$18,005.40D.

$20,889.736,7,8 please