Home /

Expert Answers /

Economics /

consider-the-following-data-personal-income-589-undistributed-corporate-profits-42-corporate-pa969

(Solved): Consider the following data: Personal Income: \$589 Undistributed Corporate Profits: $42 Corporate ...

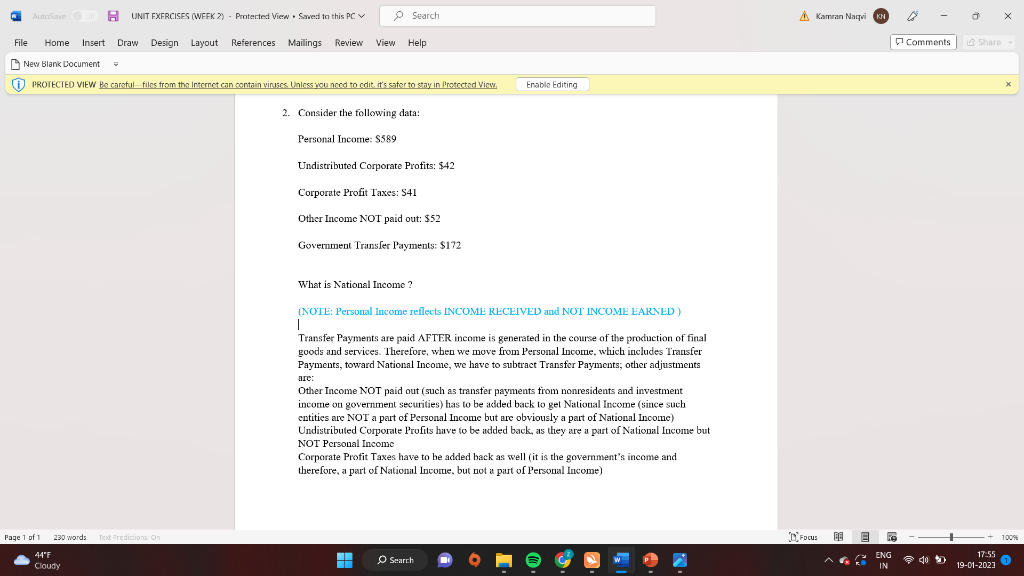

Consider the following data: Personal Income: \$589 Undistributed Corporate Profits: Corporate Profit Taxes: S41 Other Income NOT paid out: \$52 Government Transfer Payments: What is National Income? (NOIE: Personal Income reflects INCOME RECEIVED and NOT INCOME EARNED) 1 Transfer Payments are paid AFTER income is generated in the course of the production of final goods and services. Therefore, when we move from Personal lnoome, which includes Iransfer Payments, toward National Income, we have to subtract Transfer Payments; other adjustments are: Other Income NOT paid out (such as transfer payments from nonresidents and investment income on government securities) has to be added back to get National Income (since such entities are NOT a part of Personal Income but are obviously a part of National Income) Undistributed Corporate Profits have to be added back, as they are a part of National Income but NOT Personal Income Corporate Profit Taxes have to be added back as well (it is the government's income and therefore, a part of National Income, but not a part of Personal Income)

Expert Answer

National income is total amount of income that is generated i