Home /

Expert Answers /

Economics /

consider-the-market-for-a-good-that-is-currently-in-equilibrium-and-the-market-outcome-is-efficien-pa588

(Solved): Consider the market for a good that is currently in equilibrium, and the market outcome is efficien ...

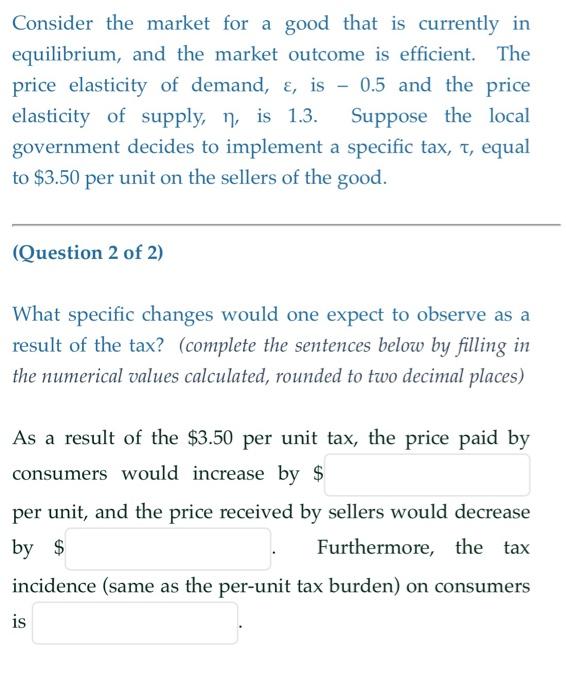

Consider the market for a good that is currently in equilibrium, and the market outcome is efficient. The price elasticity of demand, , is -0.5 and the price elasticity of supply, , is 1.3. Suppose the local government decides to implement a specific tax, , equal to per unit on the sellers of the good. (Question 2 of 2) What specific changes would one expect to observe as a result of the tax? (complete the sentences below by filling in the numerical values calculated, rounded to two decimal places) As a result of the per unit tax, the price paid by consumers would increase by per unit, and the price received by sellers would decrease by Furthermore, the tax incidence (same as the per-unit tax burden) on consumers is

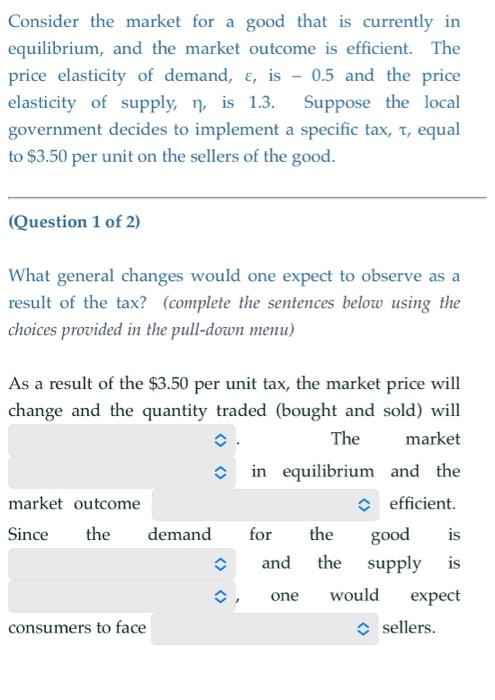

Consider the market for a good that is currently in equilibrium, and the market outcome is efficient. The price elasticity of demand, , is -0.5 and the price elasticity of supply, , is 1.3. Suppose the local government decides to implement a specific tax, , equal to per unit on the sellers of the good. (Question 1 of 2) What general changes would one expect to observe as a result of the tax? (complete the sentences below using the choices provided in the pull-down menu) As a result of the per unit tax, the market price will change and the quantity traded (bought and sold) will The market in equilibrium and the market outcome Since the demand for the good is and the supply is , one would expect consumers to face efficient. is sellers.

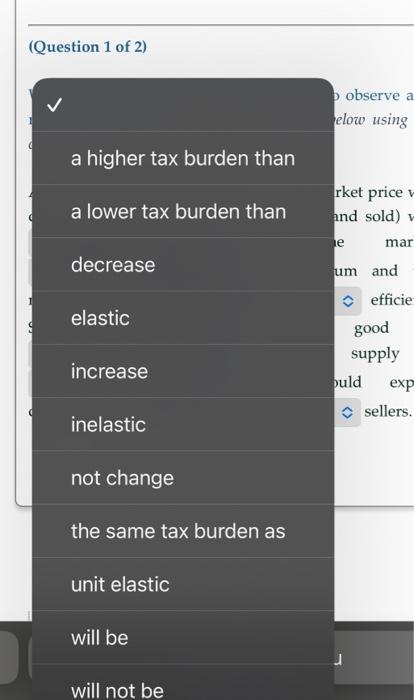

(Question 1 of 2) a higher tax burden than a lower tax burden than decrease elastic increase inelastic not change the same tax burden as as asing unit elastic will be will not be