Home /

Expert Answers /

Accounting /

corporate-tax-liability-the-talley-corporation-had-taxable-opbating-income-of-400-000-i-e-earnin-pa879

(Solved): Corporate Tax Liability The Talley Corporation had taxable opbating income of $400,000 (i.e., earnin ...

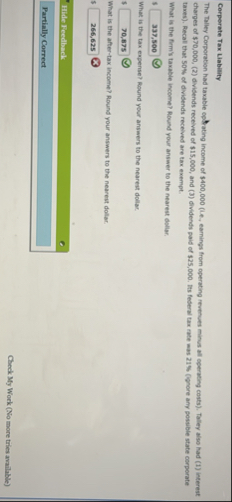

Corporate Tax Liability The Talley Corporation had taxable opbating income of

$400,000(i.e., earnings from operating revenues minus all coerating costs), Talley also Rad (1) interest charges of

$70,000,(2)dividends received of

$15,000, and (3) dividends paid of

$25,000. Tis federal tax rate mas grore any possible state corporate taxes). Recal that 50% of dividends received are tax exempt. What is the from's taxable income? Round your answer to the nearest chilar. 5

_(_())_(_())What is the tax expense? Round your answers to the nearest dollar. 5

_(_())_(_())47. at is the after-tax income? Round your answers to the nearest dollar. 5

_(_())_(_())63 Filde Feedlayek Partially Correct Check My Work (No more tries available)