Home /

Expert Answers /

Finance /

correct-answer-is-653686-89-plss-help-finance-consider-an-income-property-that-is-under-evaluation-pa281

(Solved): correct answer is $653686.89 plss help finance Consider an income property that is under evaluation ...

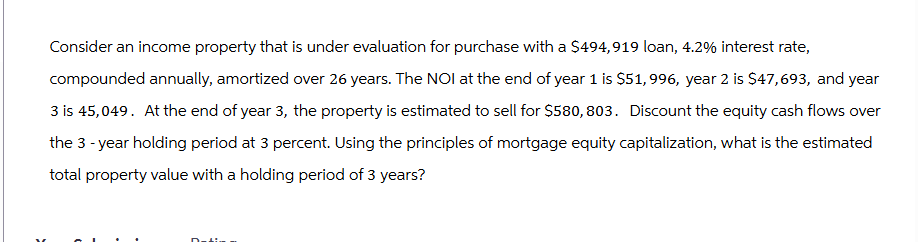

correct answer is $653686.89 plss help finance Consider an income property that is under evaluation for purchase with a \$494,919 loan, \( 4.2 \% \) interest rate, compounded annually, amortized over 26 years. The NOI at the end of year 1 is \( \$ 51,996 \), year 2 is \( \$ 47,693 \), and year 3 is 45,049 . At the end of year 3 , the property is estimated to sell for \( \$ 580,803 \). Discount the equity cash flows over the 3 -year holding period at 3 percent. Using the principles of mortgage equity capitalization, what is the estimated total property value with a holding period of 3 years?