(Solved): Crane Lumber, Inc., is considering purchasing a new wood saw that costs \( \$ 65,000 \). The saw wil ...

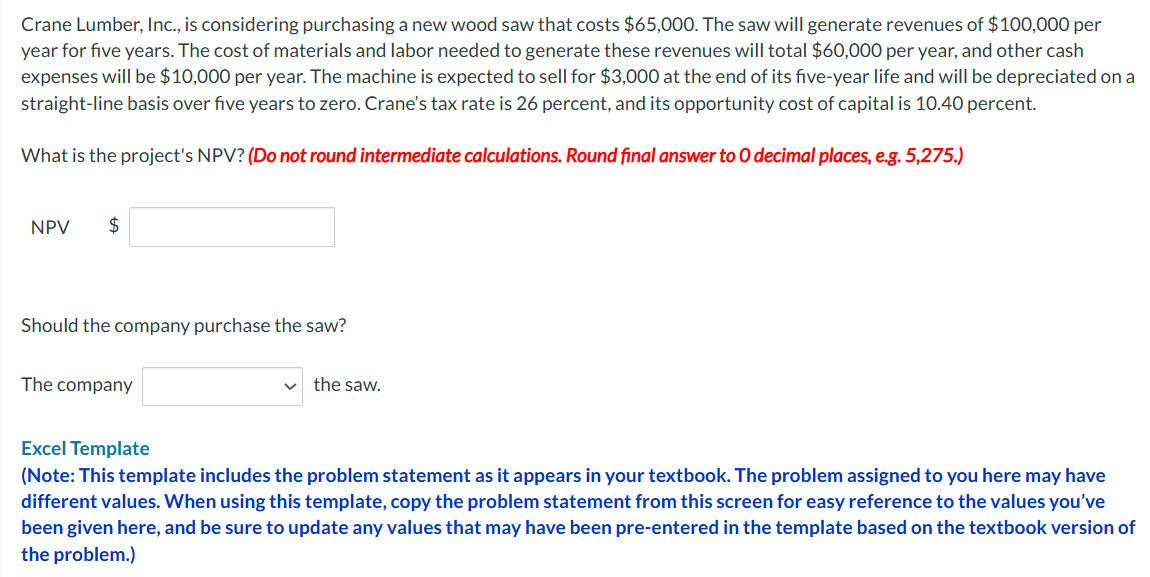

Crane Lumber, Inc., is considering purchasing a new wood saw that costs \( \$ 65,000 \). The saw will generate revenues of \( \$ 100,000 \) per year for five years. The cost of materials and labor needed to generate these revenues will total \( \$ 60,000 \) per year, and other cash expenses will be \( \$ 10,000 \) per year. The machine is expected to sell for \( \$ 3,000 \) at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Crane's tax rate is 26 percent, and its opportunity cost of capital is 10.40 percent. What is the project's NPV? (Do not round intermediate calculations. Round final answer to 0 decimal places, e.g. 5,275.) NPV \$ Should the company purchase the saw? The company the saw. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.)