Home /

Expert Answers /

Accounting /

danus-corporation-purchased-major-pleces-of-manufacturing-equipment-on-january-1-2020-for-a-total-o-pa365

(Solved): Danus Corporation purchased major pleces of manufacturing equipment on January 1,2020 for a total o ...

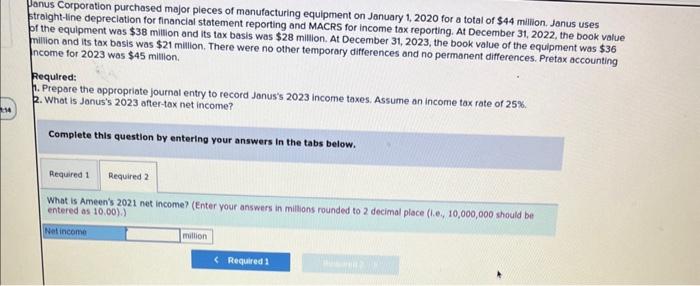

Danus Corporation purchased major pleces of manufacturing equipment on January 1,2020 for a total of \$44 million. Janus uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2022, the book value of the equipment was \( \$ 38 \) miltion and its tax basis was \( \$ 28 \) million. At December 31,2023 , the book value of the equipment was \( \$ 36 \) million and its tax basis was \( \$ 21 \) million. There were no other temporary differences and no permanent differences. Pretax accounting ncome for 2023 was \( \$ 45 \) million. Required: 1. Prepore the appropriate journal entry to record Janus's 2023 income taxes. Assume an income tax rate of \( 25 \% \). 2. What is Janus's 2023 after-tax net income? Complete this question by entering your answers in the tabs below. What is Ameen's 2021 net income? (Enter your answers in millions rounded to 2 decimal place (l.e., 10,000,000 should be entered as \( 10.001 \) ).

Expert Answer

1) Journal entry: A journal entry is used to record a business transaction in