Home /

Expert Answers /

Accounting /

during-the-current-year-collins-company-reported-a-net-operating-loss-of-1-200-on-its-tax-pa766

(Solved): During the current year, Collins Company reported a net operating loss of \( \$ 1,200 \) on its tax ...

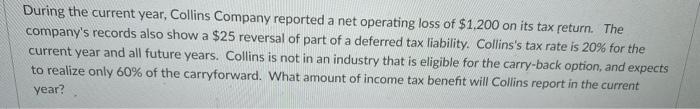

During the current year, Collins Company reported a net operating loss of \( \$ 1,200 \) on its tax return. The company's records also show a \( \$ 25 \) reversal of part of a deferred tax liability. Collins's tax rate is \( 20 \% \) for the current year and all future years. Collins is not in an industry that is eligible for the carry-back option, and expects to realize only \( 60 \% \) of the carryforward. What amount of income tax benefit will Collins report in the current year?

Expert Answer

Expected Loss carryforward =Net ope