(Solved): Effect of a tax on buyers and sellers The following graph shows the weekly market for sweatpants i ...

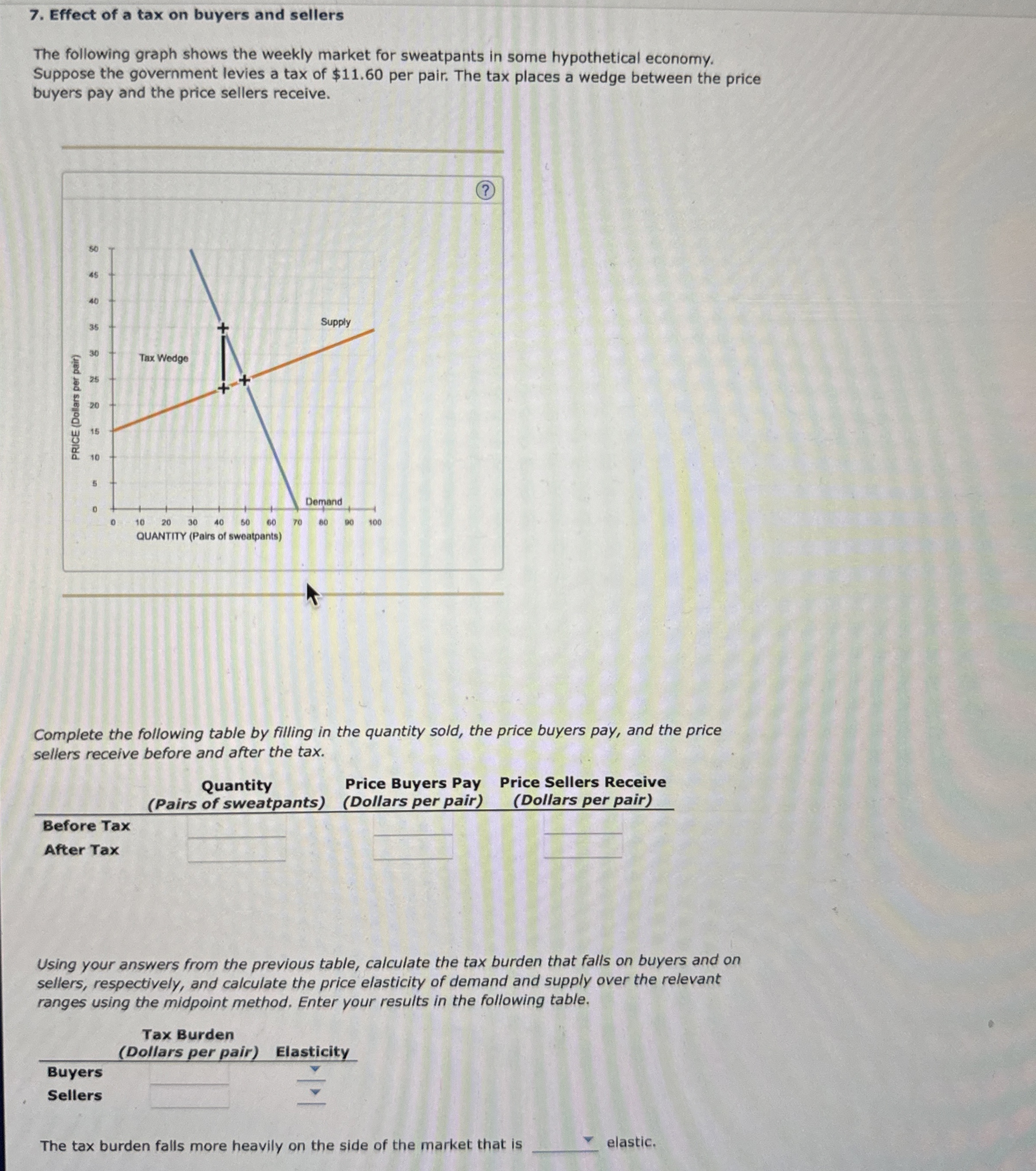

Effect of a tax on buyers and sellers The following graph shows the weekly market for sweatpants in some hypothetical economy. Suppose the government levies a tax of

$11.60per pair. The tax places a wedge between the price buyers pay and the price sellers receive. Complete the following table by filling in the quantity sold, the price buyers pay, and the price sellers receive before and after the tax. \table[[,\table[[(Pair]],\table[[Quantity],[s of sweatpants)]],\table[[Price Buyers Pay],[(Dollars per pair)]],\table[[Price Sellers Receive],[(Dollars per pair)]]],[Before Tax,,,,],[After Tax,,,,]] Using your answers from the previous table, calculate the tax burden that falls on buyers and on sellers, respectively, and calculate the price elasticity of demand and supply over the relevant ranges using the midpoint method. Enter your results in the following table, \table[[,\table[[Tax Burden],[(Dollars per pair)]],Elasticity],[Buyers,,],[Sellers,,]] The tax burden falls more heavily on the side of the market that is

◻elastic.