(Solved): Exercise 11-24 (Algo) Change in principle; change in depreciation methods [LO11-2, 11-6] Alteran Co ...

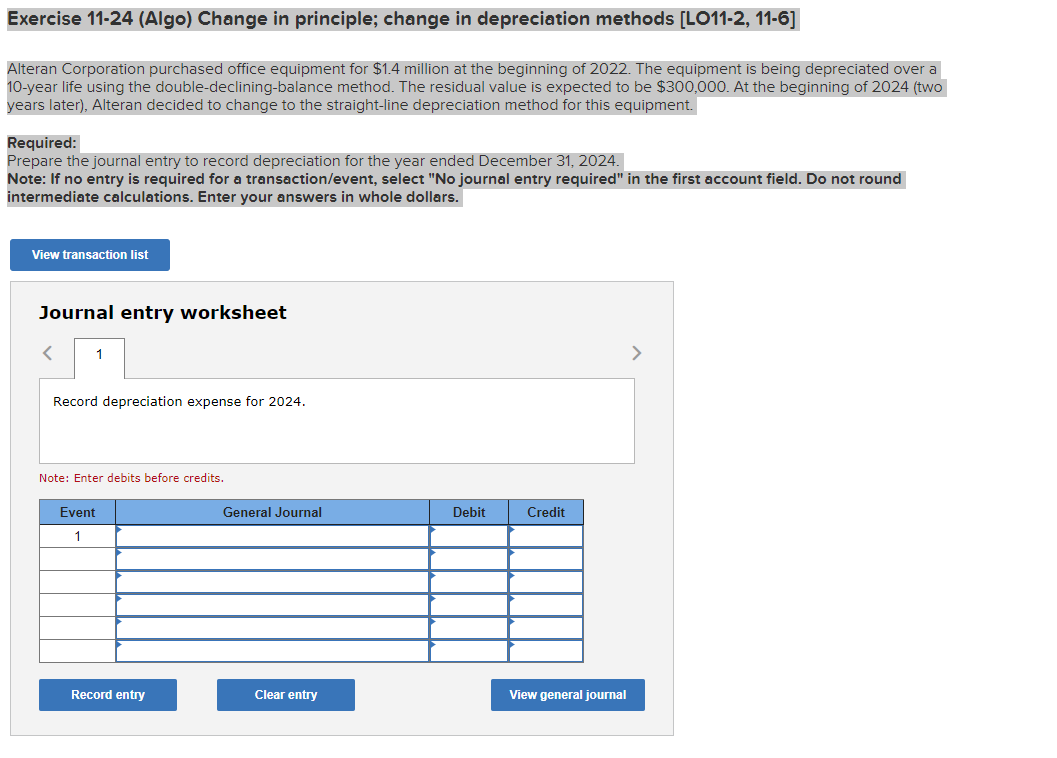

Exercise 11-24 (Algo) Change in principle; change in depreciation methods [LO11-2, 11-6] Alteran Corporation purchased office equipment for

$1.4million at the beginning of 2022 . The equipment is being depreciated over a 10 -year life using the double-declining-balance method. The residual value is expected to be

$300,000. At the beginning of 2024 (two years later), Alteran decided to change to the straight-line depreciation method for this equipment. Required: Prepare the journal entry to record depreciation for the year ended December 31, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in whole dollars. Journal entry worksheet Record depreciation expense for 2024. Note: Enter debits before credits.