(Solved): Exercise 2-13A (Algo) Unearned items on financial statements LO 2-7, 2-8 Yard Designs (YD) experienc ...

Exercise 2-13A (Algo) Unearned items on financial statements LO 2-7, 2-8 Yard Designs (YD) experienced the following events in Year 1, its first year of operation: On October 1, Year 1, YD collected

$32,400for consulting services it agreed to provide during the coming year. Adjusted the accounts to reflect the amount of consulting service revenue recognized in Year 1. Required: Based on this information alone: a. Record the events under an accounting equation. b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of service revenue that would be recognized in Year 2 ? Complete this question by entering your answers in the tabs below. \table[[Req

A,\table[[Req B1],[Income],[statement]],\table[[Req B2],[Balance sheet]],\table[[Req B3],[Statement of],[cash flows]],Req C]] Note: Do not round intermediate calculations. Enter any decreases to account balances with a minus sign. Not all cells require Record the events under an accounting equation. input. \table[[YARD DESIGNS],[Accounting Equation Year 1],[Event,Assets,

=,Liabilities,+,\table[[Stockholders'],[Equity]]],[Cash,

=,\table[[Unearned],[Revenue]],+,Retained Earnings],[Event,,

=,,+,],[Adjusting,,

=,,+,],[,,

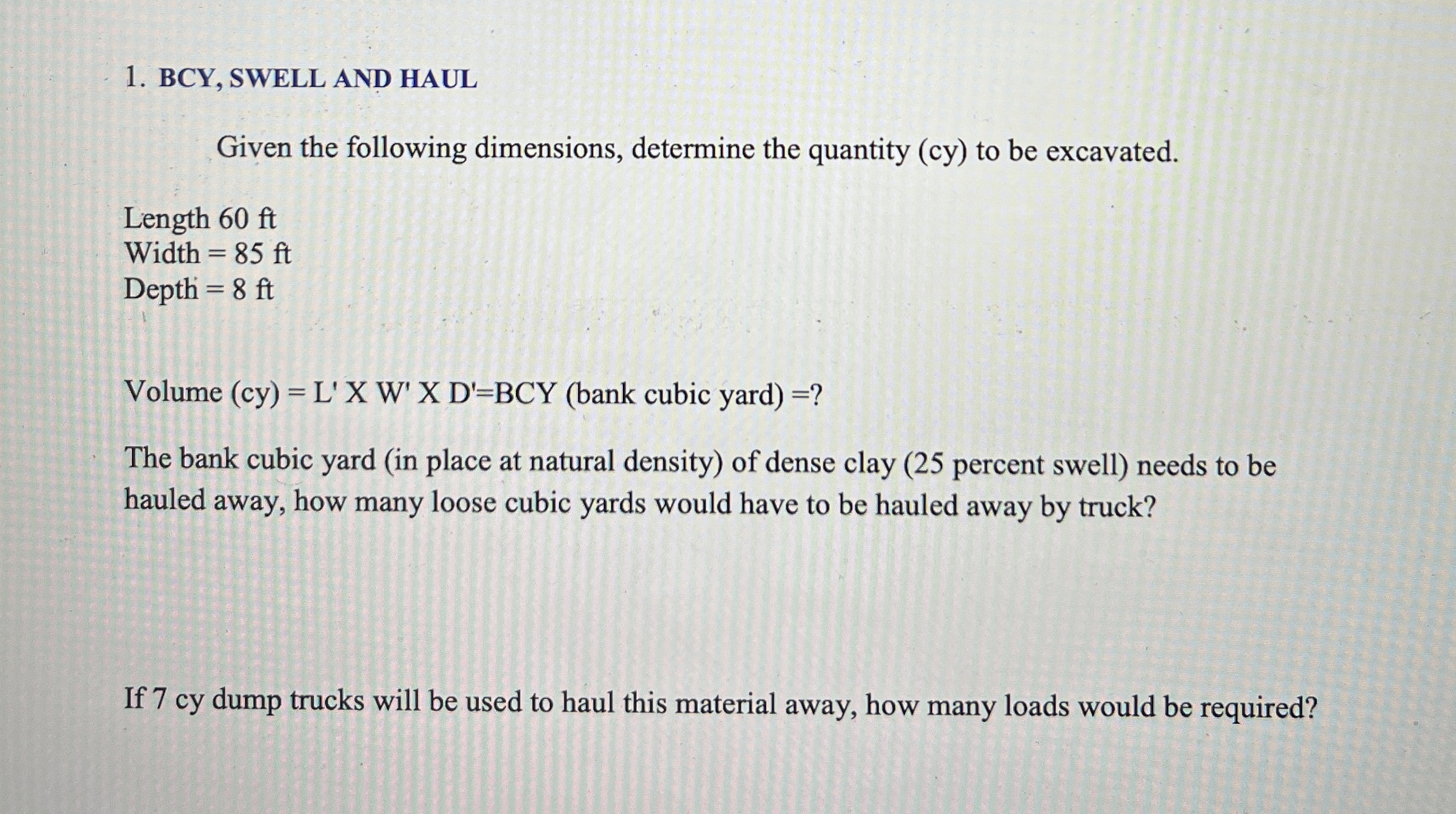

=,,+,0]] BCY, SWELL AND HAUL Given the following dimensions, determine the quantity (cy) to be excavated.

Length 60ft

Width =85ft

Depth =8ftVolume bank cubic yard