(Solved): February 26 The company paid cash to Lyn Addie for eight days' work at $120 per day. Hartford Resea ...

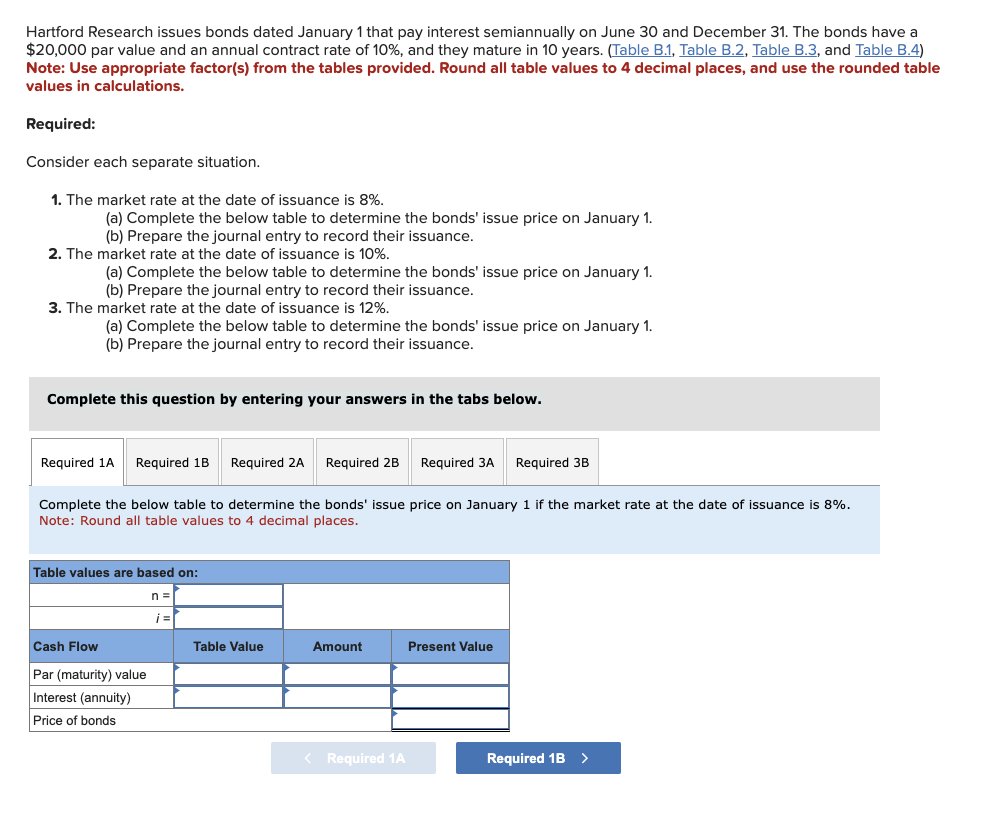

February 26 The company paid cash to Lyn Addie for eight days' work at $120 per day. Hartford Research issues bonds dated January 1 that pay interest semiannually on June 30 and December 31. The bonds have a

$20,000par value and an annual contract rate of

10%, and they mature in 10 years. (Table B.1, Table B.2, Table B.3, and Table B.4) Note: Use appropriate factor(s) from the tables provided. Round all table values to 4 decimal places, and use the rounded table values in calculations. Required: Consider each separate situation. The market rate at the date of issuance is

8%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. The market rate at the date of issuance is

10%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. The market rate at the date of issuance is

12%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. Complete this question by entering your answers in the tabs below. Complete the below table to determine the bonds' issue price on January 1 if the market rate at the date of issuance is

8%. Note: Round all table values to 4 decimal places. March 25 The company sold merchandise with a $2,800 cost for $2,900 on credit to Wildcat Services, invoice dated March 25. Required: Assume that Lyn Addie is an unmarried employee. Her $960 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $96. Compute her net pay for the eight days' work paid on February 26. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). Record the entries for the merchandise sold on March 25 if a 4% sales tax rate applies.