Home /

Expert Answers /

Accounting /

fill-out-the-chart-and-what-is-the-impairment-loss-property-plant-and-equipment-we-review-long-li-pa717

(Solved): fill out the chart and what is the impairment loss?? Property, Plant and Equipment We review long-li ...

fill out the chart and what is the impairment loss??

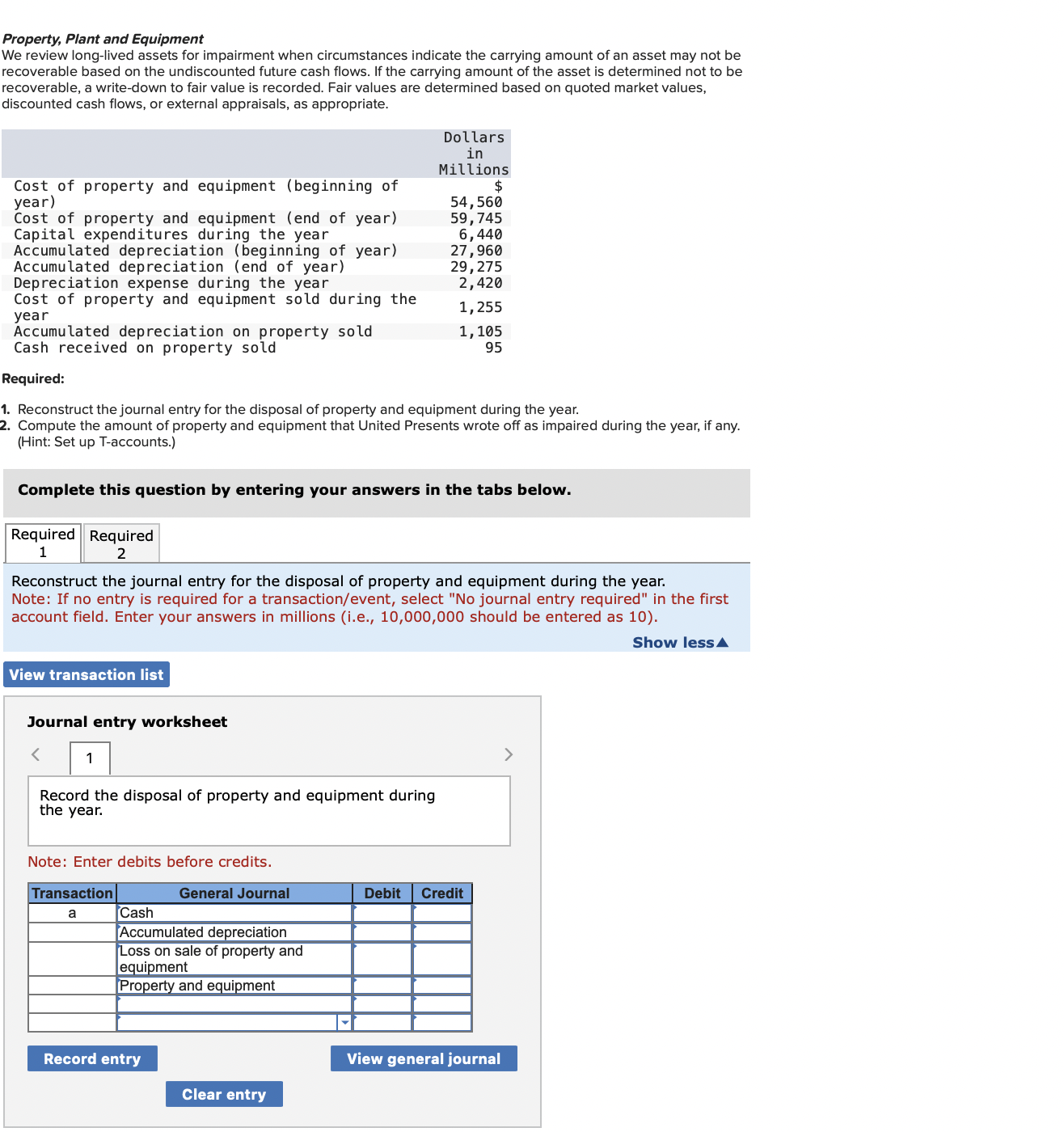

Property, Plant and Equipment We review long-lived assets for impairment when circumstances indicate the carrying amount of an asset may not be recoverable based on the undiscounted future cash flows. If the carrying amount of the asset is determined not to be recoverable, a write-down to fair value is recorded. Fair values are determined based on quoted market values, discounted cash flows, or external appraisals, as appropriate. Required: 1. Reconstruct the journal entry for the disposal of property and equipment during the year. 2. Compute the amount of property and equipment that United Presents wrote off as impaired during the year, if any. (Hint: Set up T-accounts.) Complete this question by entering your answers in the tabs below. Reconstruct the journal entry for the disposal of property and equipment during the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Show less Journal entry worksheet Record the disposal of property and equipment during the year. Note: Enter debits before credits.

Expert Answer

In this exercise, we are asked to journalize the disposal of the property and equipment and compute the amount of impairment during the year.Costs - refers to the cash or fair value of the other consideration given to acquire an asset for the benefit of the Company.Market Value - is the price that a company can offer to sell its assets in a competitive market.Net Book Value - is computed by deducting the accumulated depreciation to the corresponding recorded cost.Depreciation - is a method of accounting to allocate the total costs of assets to the estimated useful life where the said assets help the Company to generate economic benefits.