Home /

Expert Answers /

Advanced Math /

five-years-ago-you-acquired-a-30-year-loan-of-130-850-charging-6-5-annual-interest-compounded-pa164

(Solved): Five years ago, you acquired a 30 -year loan of $130,850, charging 6.5% annual interest, compounded ...

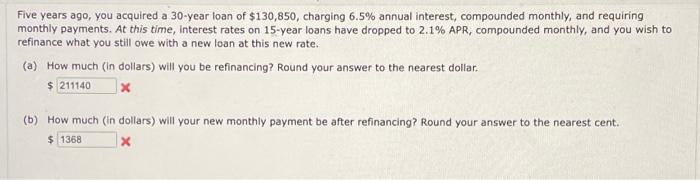

Five years ago, you acquired a 30 -year loan of , charging annual interest, compounded monthly, and requiring monthly payments. At this time, interest rates on 15 -year loans have dropped to , compounded monthly, and you wish to refinance what you still owe with a new loan at this new rate. (a) How much (in dollars) will you be refinancing? Round your answer to the nearest dollar. (b) How much (in dollars) will your new monthly payment be after refinancing? Round your answer to the nearest cent.

Expert Answer

Given the information in the problem is time = 30 yearsloan amount = $130,850interest rate = 6.5% (a) We need to calculate the amount that you owe on the 30-year loan.To calculate the amount that you owe on the 30-year loan, let us use the formula for the present value of an annuity. It is given as below ; The terms are explained as PV is the present value of the loan, PMT is the monthly payment, r is the annual interest rate, n is the number of times the interest is compounded per year, t is the total number of payment periods