Home /

Expert Answers /

Finance /

fiverrocks-whose-wacc-is-11-3-is-considering-an-acquisition-of-rat-adventures-whose-wa-pa840

(Solved): FiverRocks (whose WaCC is \( 11.3 \% \) ) is considering an acquisition of Rat Adventures (whose Wa ...

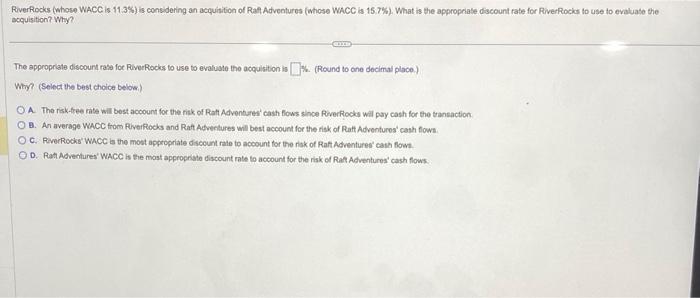

FiverRocks (whose WaCC is \( 11.3 \% \) ) is considering an acquisition of Rat Adventures (whose WaCC is 15 7\%). What is the appropriate discount rate for RiverRocks to use to evaluate the acouisition? Why? The appropriste discourt rase foc RiverRocks to use to evaluaste the acquisition is K. (Round to ane decimal place.) Why? (Select the best choice below.) A. The risk-tree rite will bost account for the risk of Ratt Adventures' cash fiows shce RoverRocks wil pay cash for the transaction: B. Ar average WacC from Rlverfocks and Raft Adventures will best account for the risk of Ratt Adventures' cash flowa. C. RewerRocks' WhCC is the most appropriate discount rate to acoount for the rak of Raft Adventures' cast flowt. D. Pat Advertures' WaCC is the most appropriate discount rate to account for the risk od Rat Adventures' cash flows.

Expert Answer

The rate at which the total amount paid out under an immediate perpetuity arrangement