Home /

Expert Answers /

Accounting /

for-calendar-year-2021-sandhill-corp-reported-depreciation-of-1680000-in-its-income-statement-on-pa388

(Solved): For calendar year 2021, Sandhill Corp. reported depreciation of $1680000 in its income statement. On ...

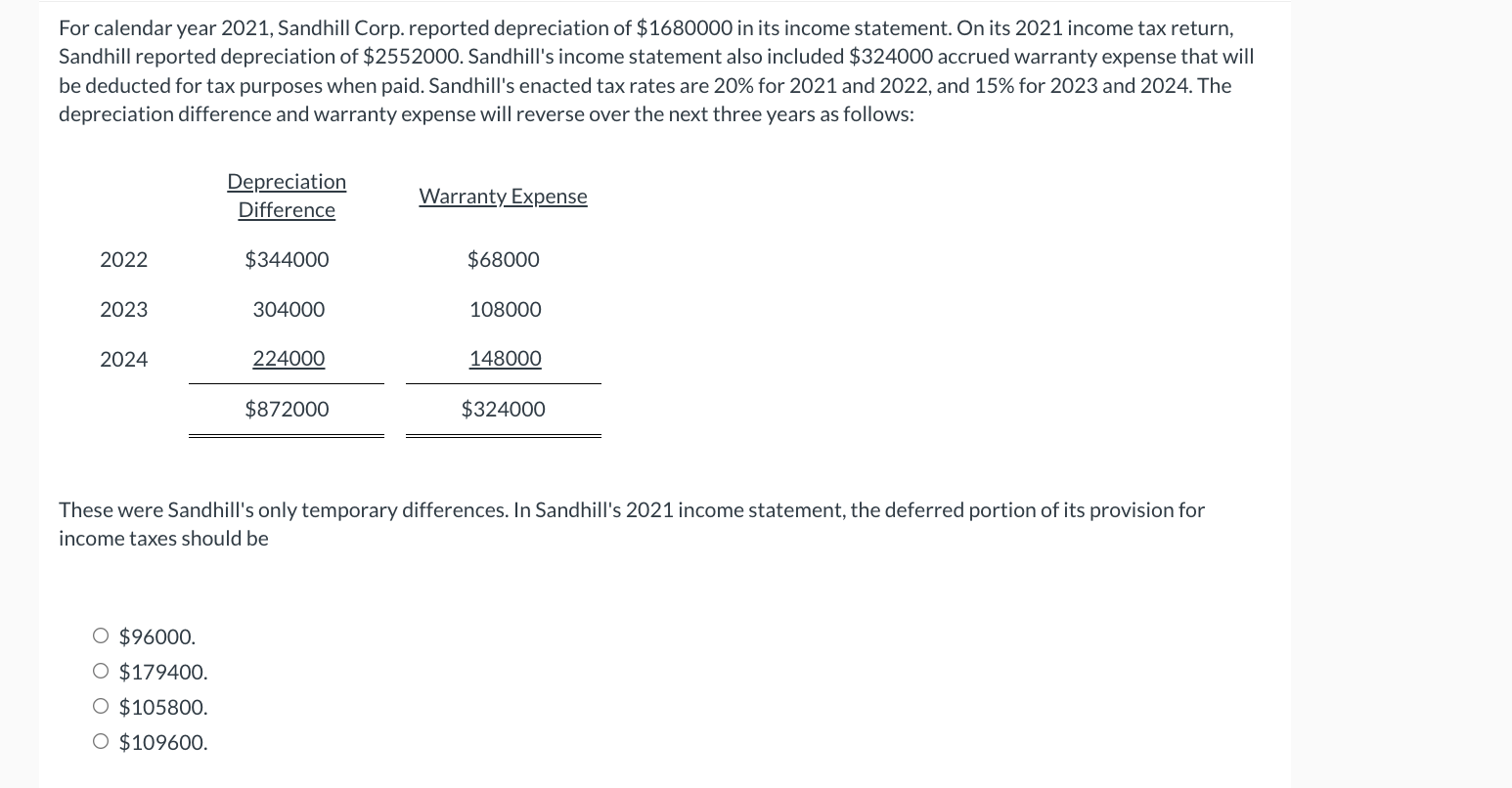

For calendar year 2021, Sandhill Corp. reported depreciation of

$1680000in its income statement. On its 2021 income tax return, Sandhill reported depreciation of

$2552000. Sandhill's income statement also included

$324000accrued warranty expense that will be deducted for tax purposes when paid. Sandhill's enacted tax rates are

20%for 2021 and 2022, and

15%for 2023 and 2024. The depreciation difference and warranty expense will reverse over the next three years as follows: These were Sandhill's only temporary differences. In Sandhill's 2021 income statement, the deferred portion of its provision for income taxes should be

$96000.

$179400.

$105800.

$109600.