Home /

Expert Answers /

Finance /

future-value-you-have-100-to-invest-if-you-put-the-money-into-an-account-earning-5-interest-co-pa376

(Solved): Future value. You have $100 to invest. If you put the money into an account earning 5% interest co ...

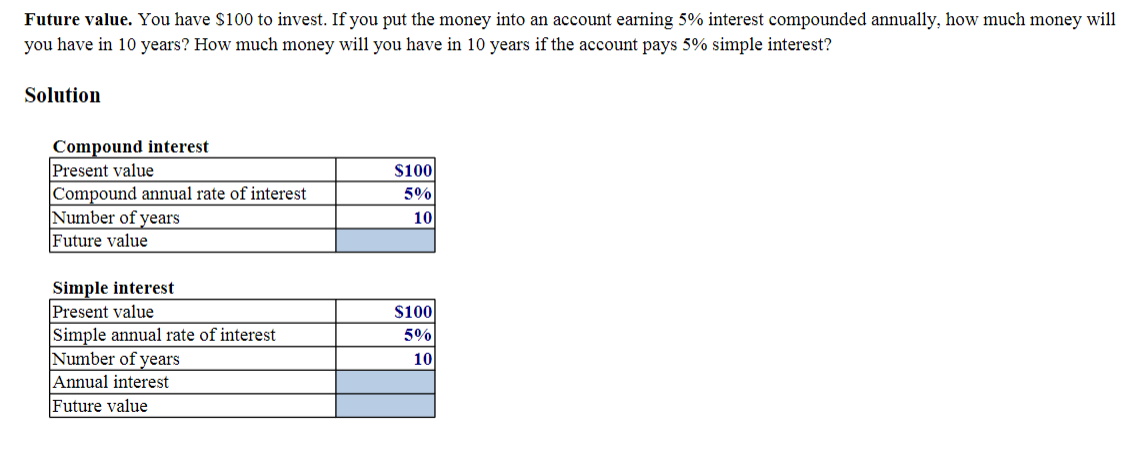

Future value. You have $100 to invest. If you put the money into an account earning 5% interest compounded annually, how much money will you have in 10 years? How much money will you have in 10 years if the account pays 5% simple interest? Solution Compound interest Present value $100 Compound annual rate of interest 5% Number of years Future value Simple interest Present value Simple annual rate of interest Number of years Annual interest Future value 10 $100 5% 10

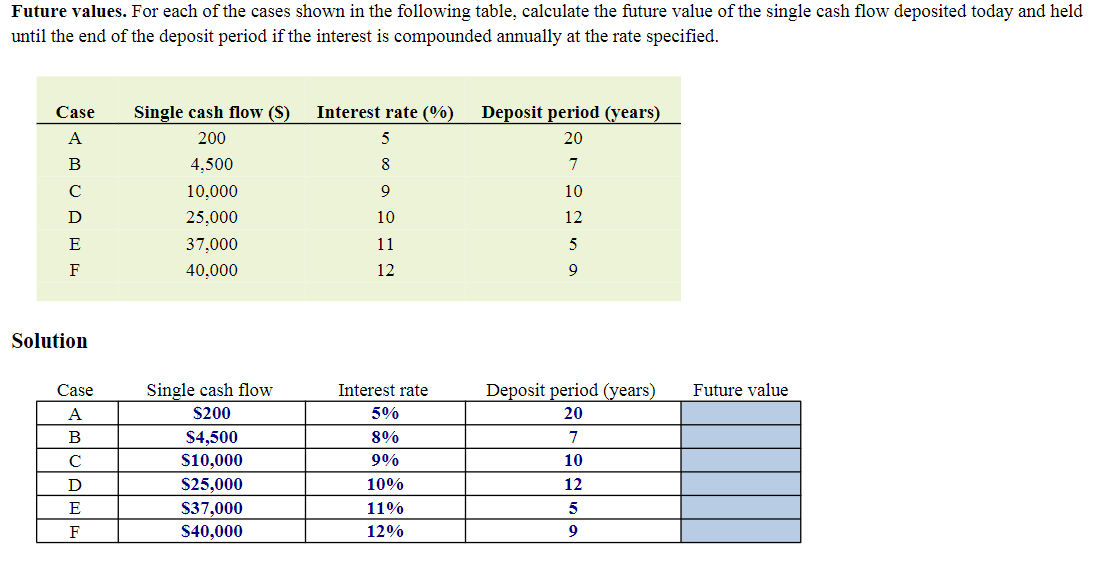

Future values. For each of the cases shown in the following table, calculate the future value of the single cash flow deposited today and held until the end of the deposit period if the interest is compounded annually at the rate specified. Case Single cash flow (S) Interest rate (%) Deposit period (years) A 200 5 20 B 4,500 8 7 ? 10,000 9 10 D 25,000 10 12 E 37,000 11 5 F 40,000 12 9 Solution Case Single cash flow Interest rate Deposit period (years) A $200 5% 20 B $4,500 8% 7 ? $10,000 9% 10 D $25,000 10% 12 E $37,000 11% 5 F $40,000 12% 9 Future value

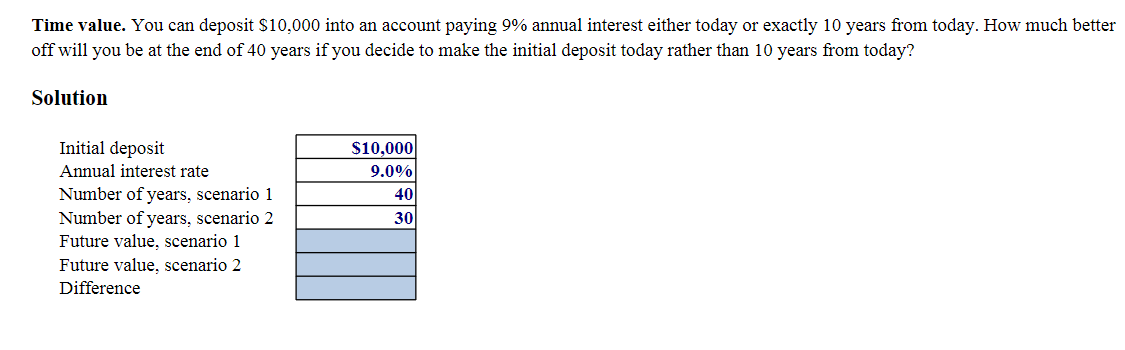

Time value. You can deposit $10,000 into an account paying 9% annual interest either today or exactly 10 years from today. How much better off will you be at the end of 40 years if you decide to make the initial deposit today rather than 10 years from today? Solution Initial deposit $10,000 Annual interest rate 9.0% Number of years, scenario 1 Number of years, scenario 2 Future value, scenario 1 Future value, scenario 2 Difference 40 30

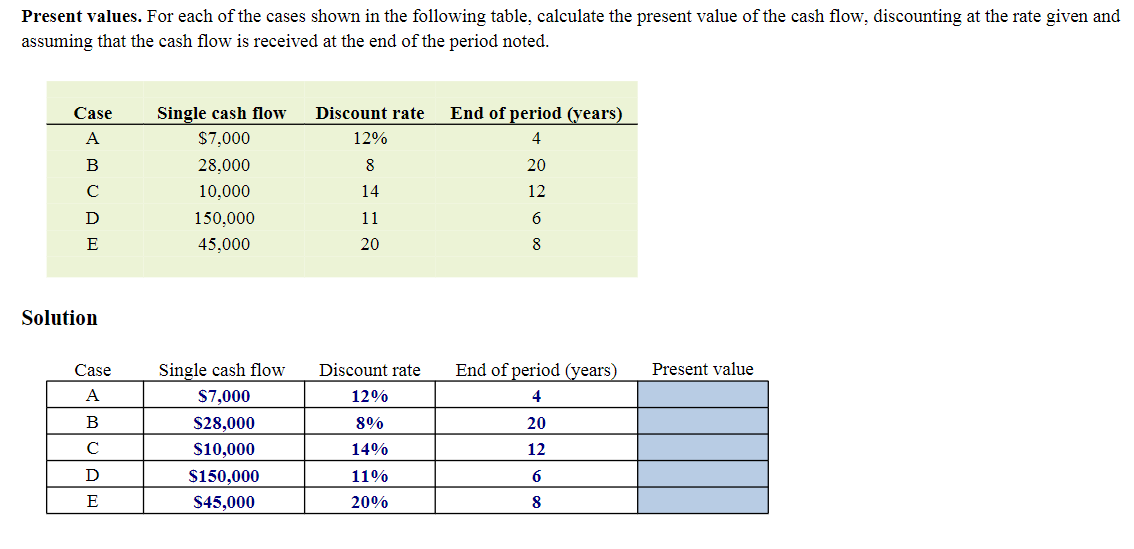

Present values. For each of the cases shown in the following table, calculate the present value of the cash flow, discounting at the rate given and assuming that the cash flow is received at the end of the period noted. Case Single cash flow Discount rate End of period (years) $7,000 12% 4 28,000 8 20 10,000 12 150,000 6 45,000 8 Single cash flow End of period (years) $7,000 4 $28,000 20 $10,000 12 $150,000 6 $45,000 8 ABCDE Solution Case A B ? D E • 14 11 20 Discount rate 12% 8% 14% 11% 20% Present value

Expert Answer

Future value = Present value * (1+r)^n r= rate of interest for the period (it can be monthly, quarterly, semi-annually, annual) n= No o f periods/years 1) Compound interest Present value $100 Compound annual interest rate (r) 5% No of years (n) 10 Fu