Home /

Expert Answers /

Economics /

hardmon-enterprises-is-currently-an-al-eevity-firm-with-an-expected-retuen-of-14-9-it-is-consider-pa587

(Solved): Hardmon Enterprises is currently an al-eevity firm with an expected retuen of 14.9%. It is consider ...

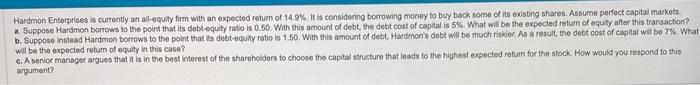

Hardmon Enterprises is currently an al-eevity firm with an expected retuen of . It is considering borrowing money to buy back some of its existing shares. Assume porfect capital markets a. Suppose Hardmon borrows to the point that its debteequity ravo is . With this amount of debt, the debt cost of capital is . What will be the expected retum of equity atter this transaction? b. Suppose instead Hardmon borrows to the point that its debt-equity rato is . With this amount of debt, Hardmon's dobt wil be much riskiec. As a result, the debt cost of capitat wit bo . Wha will be the expected retum of equity in this case? c. A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would you respond to this argument?

Expert Answer

Introduction:Hardmon Enterprises is considering borrowing money to buy back some of its existing shar