(Solved): Heuary 1. 2023 . The $1 milion of sis'year, 10% bayatle annualy on December 31, Marting Deoember 31, ...

Heuary 1. 2023 . The

$1milion of sis'year,

10%bayatle annualy on December 31, Marting Deoember 31, 2023, conoertaie bonds bonds are comertible at the inveitorisopilion. The compary's book keper recorded the bonds at 109 ind, bated on the

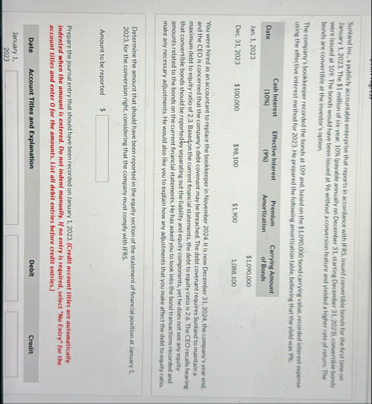

$1.090000bond carrying value, recoerded intereat expenene using the effective interest methouf for 2023 . He prepared the following imortiration table, believing that the pleld was ons. \table[[Date,Cashinterest (1094),Iffective Interest ( 9 K ),Premium Amortiaation,Carrying Amont of Bonds],[Ian 1.2023,,,,$1.0W0,000],[Dec. 31, 2023,$100,000,$94.100,$1.900,1.04t.150]] You were hired as an accountant to replace the bookkeeper in November 2024. it is now December 31, 2024, the company/ ivar end, and the CEO is concerned that the company's debt covenunt may be breached. The debt covenant requires Suinland to maintain a that convertible bonds should bereported dy separating out the liability and equity components, yet he does not see any equity amounts related to the bonds on the current finarcial statements. He has ashed you fo look into the bond tramactions reconded and make any necessary adfutments. He world also libe you to eaplain how any adputments that you make affect the debet bo equity ratio. Determine the amount that should have been reported in the equity section of the statement of franclal position at January 1. 2023 , for the comversion right, considering that the compary must comply with if its. Amount to be reported 5 Prepare the journal entry that should have been reconded on lanuary 1.2023 . (Credit account titles are aubomatically indeoted whes the amount is entered. Do not indent manually. H no entry is required, select "Ne Eatry" for the account titles and enler

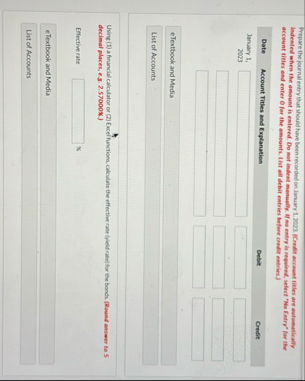

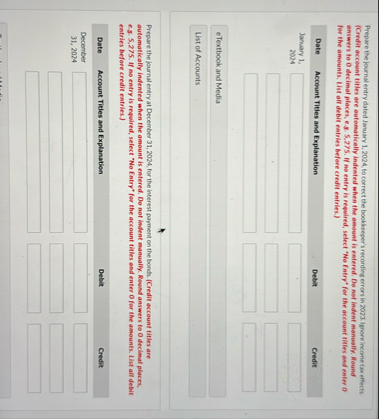

Ofor the amounts. IIst all deblt entries belore credit entries.] Date January 1 , Account Tities and Explanation Debit Credit:Irepare the journal entry that should have been reconded on laruary 1.2021 . Crndif accanef tifles are avtemeatically account titles and enter

Ofor the embunts. List all debit entries heflore condit entrien.) List of Accounts Uving (1) a finuncial calculator or (2) Excel functions, calculate the effective rabe bield ratelfor tex bond. (Round ansoer bo 5 decimal places, e.s.

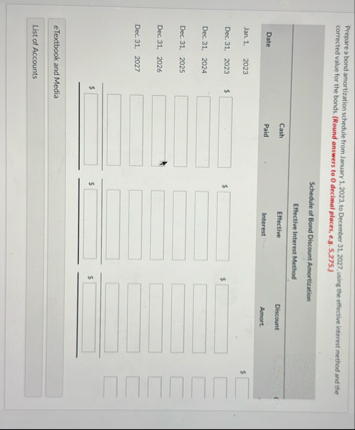

2.57000%.) Effective rabe

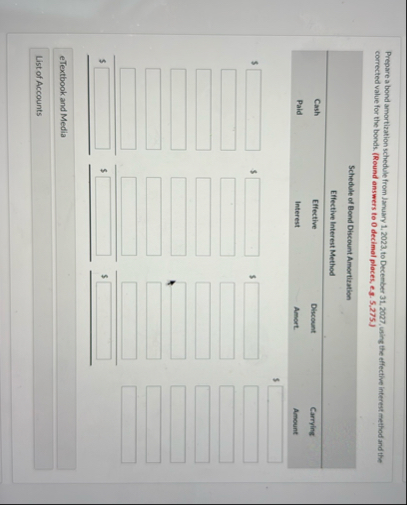

◻eTextbook and Media List of AccountsPrepare a bond amortization schedule from January 1.2023, to December 31. 2022, wing the eflective interest method and the corrected value for the bonds. (Reund answers to 0 decimal places, e.3.5.275.] eTextbook and Media List of AccountsPrepare a bond amortization schedule from Jamuary 1, 2023, to December 31, 2027, using the effective interest method and the corrected value for the bonds. (Reund answers to 0 decimal places, e.s. 5.275.) Schedule of Bond Discount Amortiration Effective Interest Method \table[[Cash,Effective,Discount],[Paid,Interest,Amort.],[,,]] 5 5

◻

◻

◻

◻

◻

◻5

◻

◻

◻

$

◻

◻

◻

◻

◻

◻

$5

◻

◻eTextbook and Media List of AccountsPrepare the journal entry dated January 1. 2024, to correct the bookeeper's recording errors in 2023 . ignore income tax effects (Credit acceant titles are automatically indested when the amount is estered, Do not indent manually. Maund enswers to 0 decimat places, e.3. 5.275. If ne entry is required, select "No Fntry' for the account titles and enter 0 for the amounts. List all debit entries before crefit enfries.) \table[[Date Account Titles and Explanation,Debit,Credit],[Jonuary 1 , 2024,,],[,,,],[,,],[, 8,,],[eTextbook and Media,,],[List of Accounts,,]] Prepare the journal entry at December 31, 2024, for the interest payment on the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.3. 5.275 . If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation December 31, 2024