I need help filling out ST-12 form

Taxable SalesNon-Taxable SalesTotal

Taxable SalesNon-Taxable SalesTotalLandscaping Services$6,032.25$774.00$8,032.25Landscaping Sales$8,600.00$2,450.00$9,824.00Total$14,632.25$3,224.0017,856.25

Craig went to a farmer’s market in Illinois mid July. During that weekend, they had sales of $1,300. This amount is included in the non-taxable Landscaping Sales. The remaining were sales for which they had exemption certificates.

Customers returned $550.00 worth of merchandise for the 3rd quarter (July - September). These were trees and shrubs that the customers found unsatisfactory.

You suggested to Craig that he write off an Invoice to Tasty Cakery from June 3, 2026. This customer's phone is disconnected and statements have been returned “no forwarding address”. The amount of sales and services provided was $375. Craig agreed and this customer’s invoice was removed from the accounting software.

Craig plans on offering snow removal services starting this winter season. He purchased heavy duty shelving for his storage facility from a supplier in Minnesota to hold the bags of salt he will be purchasing. The shelving cost $1,250. No tax was paid on this purchase.

You will complete and file the return and pay the tax by the due date. The due date for a quarterly filer is the last day of the monthly following the quarter.

Craig Smith, President will be the contact person and the signer of the ST-12 on October 15th, 2026. You will enclose the return with full payment of tax due on that date.

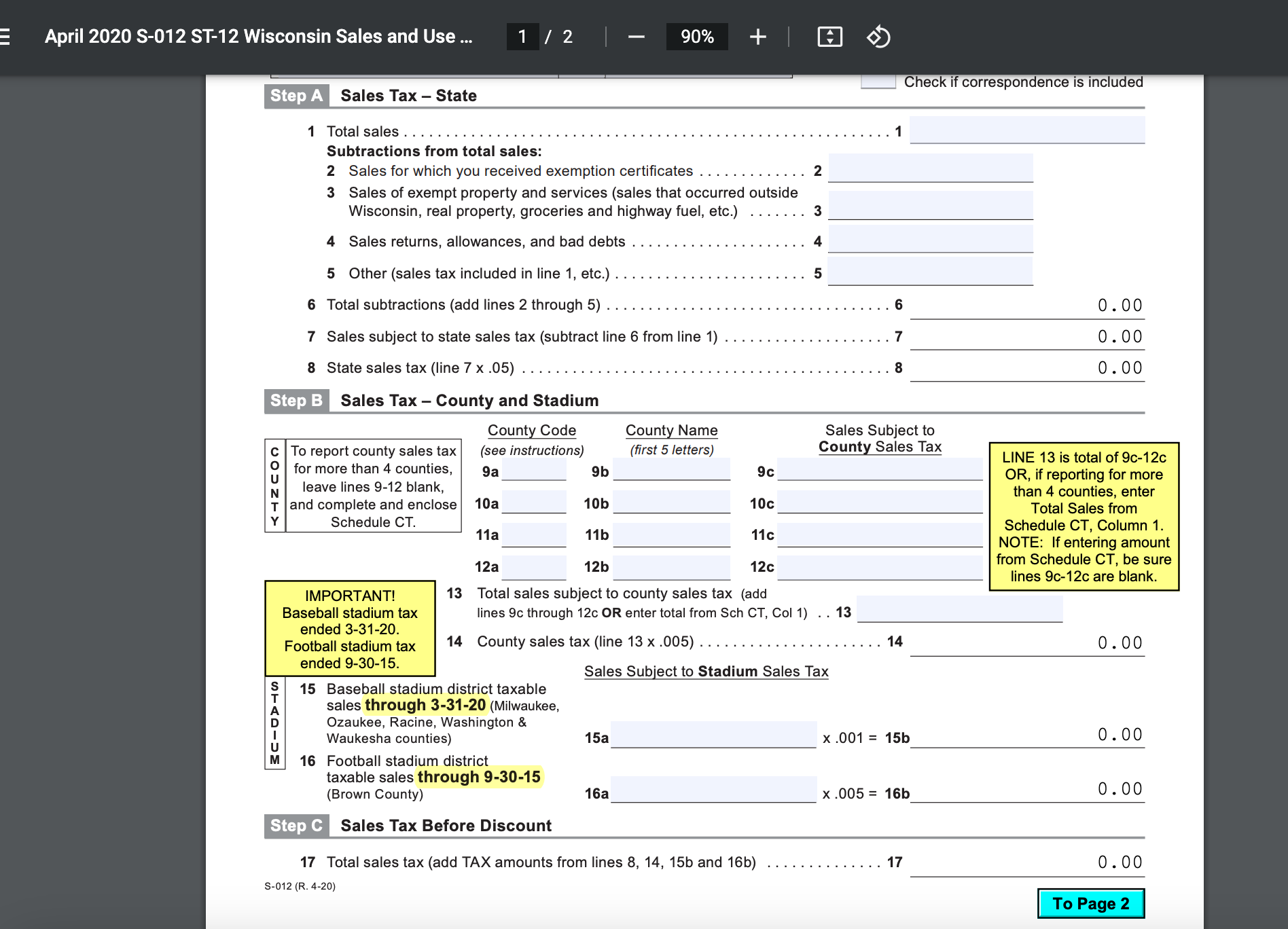

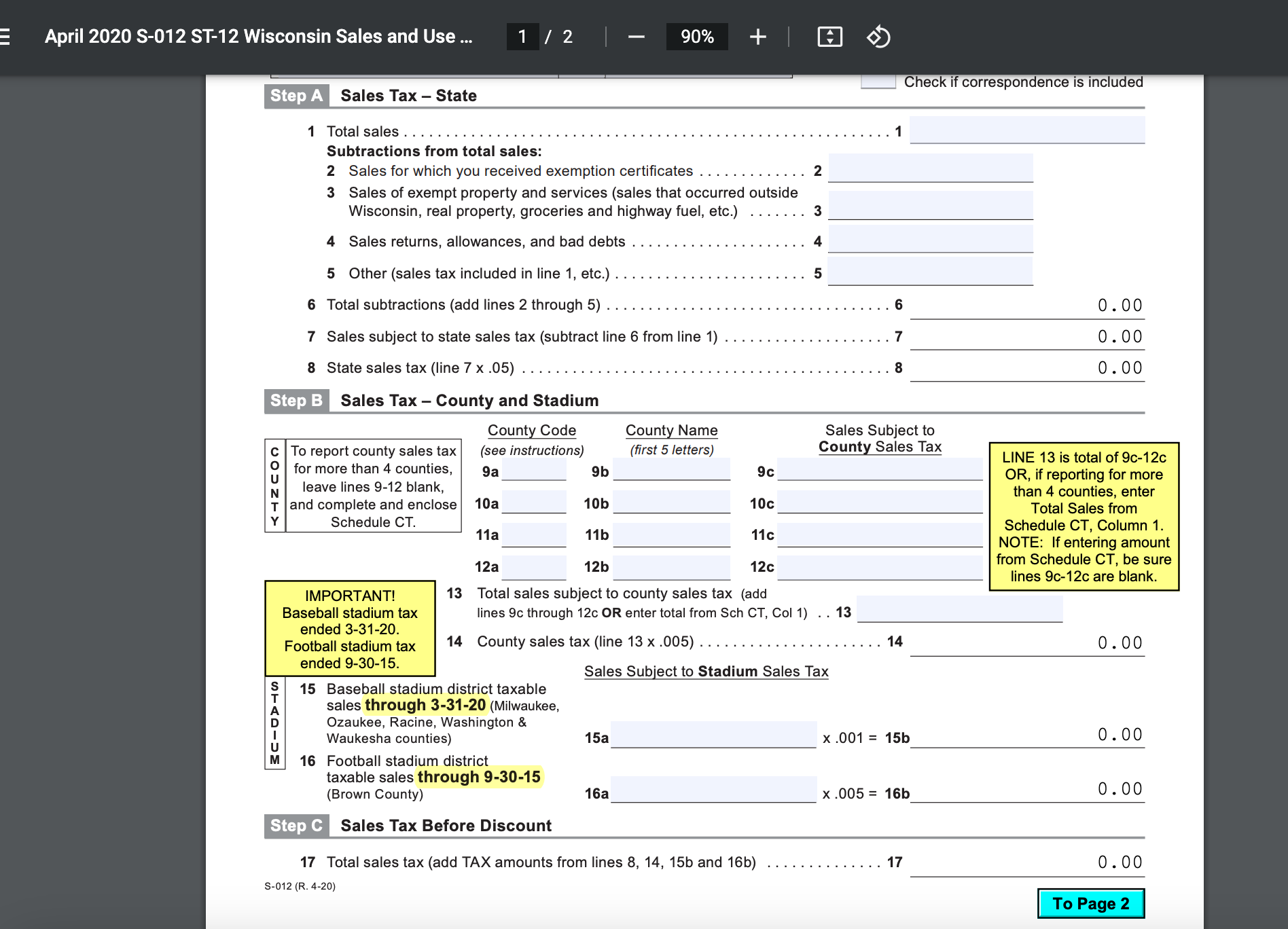

April 2020 S-012 ST-12 Wisconsin Sales and Use 1/2 90% Step A Sales Tax-State Check if correspondence is included 1 Total sales Subtractions from total sales: 2 Sales for which you received exemption certificates .......... 2 3 Sales of exempt property and services (sales that occurred outside Wisconsin, real property, groceries and highway fuel, etc.) .....3 4 Sales returns, allowances, and bad debts 4 5 Other (sales tax included in line 1, etc.) …………………… 6 Total subtractions (add lines 2 through 5) 7 Sales subject to state sales tax (subtract line 6 from line 1) 8 State sales tax (line 7×.05) \begin{tabular}{ll} 6 & 0.00 \\ \cline { 2 - 2 } & 0.00 \\ \hline 8 & 0.00 \\ \hline \end{tabular} Step B Sales Tax - County and Stadium \begin{tabular}{|l|c|} \hline C & To report county sales tax \\ O & for more than 4 counties, \\ U & leave lines 9−12 blank, \\ N & e le lanes \\ T & and complete and enclose \\ Y & Schedule CT. \\ \hline \end{tabular} County Code (see instructions) 9a 10a 11a 12a County Name (first 5 letters) 9b 10 b 11b 12b Sales Subject to County Sales Tax 9c 10c 11c 12c IMPORTANT! Baseball stadium tax ended 3-31-20. Football stadium tax ended 9-30-15. \begin{tabular}{|l|} \hline S \\ T \\ A \\ D \\ I \\ U \\ M \\ \hline \end{tabular} 15 Baseball stadium district taxable sales through 3-31-20 (Milwaukee, Ozaukee, Racine, Washington \& Waukesha counties) 13 Total sales subject to county sales tax (add lines 9c through 12c OR enter total from Sch CT, Col 1) .. 13 14 County sales tax (line 13×.005) Sales Subject to Stadium Sales Tax 16 Football stadium district taxable sales through 9-30-15 (Brown County) 15a 16a x.001=15b 0.00 OR, if reporting for more than 4 counties, enter Total Sales from Schedule CT, Column 1. NOTE: If entering amount from Schedule CT, be sure lines 9c−12c are blank. Step C Sales Tax Before Discount 17 Total sales tax (add TAX amounts from lines 8, 14, 15b and 16b) 17 0.00 S-012 (R. 4-20) To Page 2

Taxable SalesNon-Taxable SalesTotalLandscaping Services$6,032.25$774.00$8,032.25Landscaping Sales$8,600.00$2,450.00$9,824.00Total$14,632.25$3,224.0017,856.25

Taxable SalesNon-Taxable SalesTotalLandscaping Services$6,032.25$774.00$8,032.25Landscaping Sales$8,600.00$2,450.00$9,824.00Total$14,632.25$3,224.0017,856.25